In a world where every penny counts and financial clarity is the ultimate flex, finding the right tools to manage your money can feel like striking gold. Whether you're a budgeting newbie or a seasoned financial guru, having the right app can transform your financial game from chaos to a feeling of control. Welcome to our ultimate guide on the best personal financial tools, where we dive deep into the apps that can help you save, budget, invest, and even split bills with ease.

From Rocket Money's all-in-one financial tracking to YNAB's hands-on budgeting approach, and Empower's investment insights to Greenlight's kid-friendly finance lessons, we've got the scoop on tools that cater to every financial need. We'll also look at HoneyDue for couple-friendly budgeting, Coinbase for the crypto-savvy, SplitWise for hassle-free bill splitting, Wise for international money transfers, and Alix for estate settlements. So, buckle up as we break down the features, benefits, and quirks of these top financial apps, helping you find the perfect fit to master your money.

Everything we recommend

| Company | Best For |

Better Products Score |

|---|---|---|

| Rocket Money | Best overall | 4.8 |

| YNAB | Runner-up overall | 4.6 |

| Coinbase | Best for cryptocurrency management | 4.6 |

| Wise | Best for international money transfers | 4.6 |

| Greenlight | Best for kids, teens, and families | 4.6 |

| Empower.com | Best for retirement and investment management | 4.6 |

| Empower.me | Best for cash advance | 4.6 |

| Alix | Best for estate settlements | 4.2 |

| Honeydue | Best for couple finance | 4.1 |

| Splitwise | Best for group expense-sharing | 3.5 |

What We Look For

- Features and Functionality

- Budget & Expense Tracking: Creating, tracking, and managing budgets effectively

- Savings Goals: Setting and monitoring savings goals

- Investment Tracking: Portfolio tracking and analysis that are beneficial

- Debt Management: Managing and paying down debt

- Bill Reminders: Sending reminders on upcoming bills to avoid late fees

- Automatic Subscription Cancelation: Track and cancel all of those subscriptions you forgot you signed up for

- Split Bills and Send Money: Track what you own, who you owe, and then send money - even internationally.

- Miscellaneous

- Ease of Use

- User Interface: Intuitive and user-friendly design

- Setup Process: Easy to set up and start using

- Mobile Access: Has a mobile app or is mobile-friendly for on-the-go access

- Integration and Compatibility

- Bank Integration: Connectivity with bank accounts, credit cards, financial institutions, etc.

- Multi-Platform Support: Functionality across different devices

- Third-Party Integration: Compatibility with other apps and services to enhance functionality (e.g., tax software, investment platforms)

- Reviews and Reputation

- User Reviews: Summary of users’ feedback to gauge their experiences

- Expert Reviews: Comments from reputable sources and experts in personal finance

- Reputation: Trustworthiness, credibility, and history in the market

- Cost

- Free Versions: No-cost features that are actually useful

- Premium Versions: Subscription fees, one-time charges, etc.

- Value for Money: Free and paid features that justify the price or time investment

Rocket Money App Review

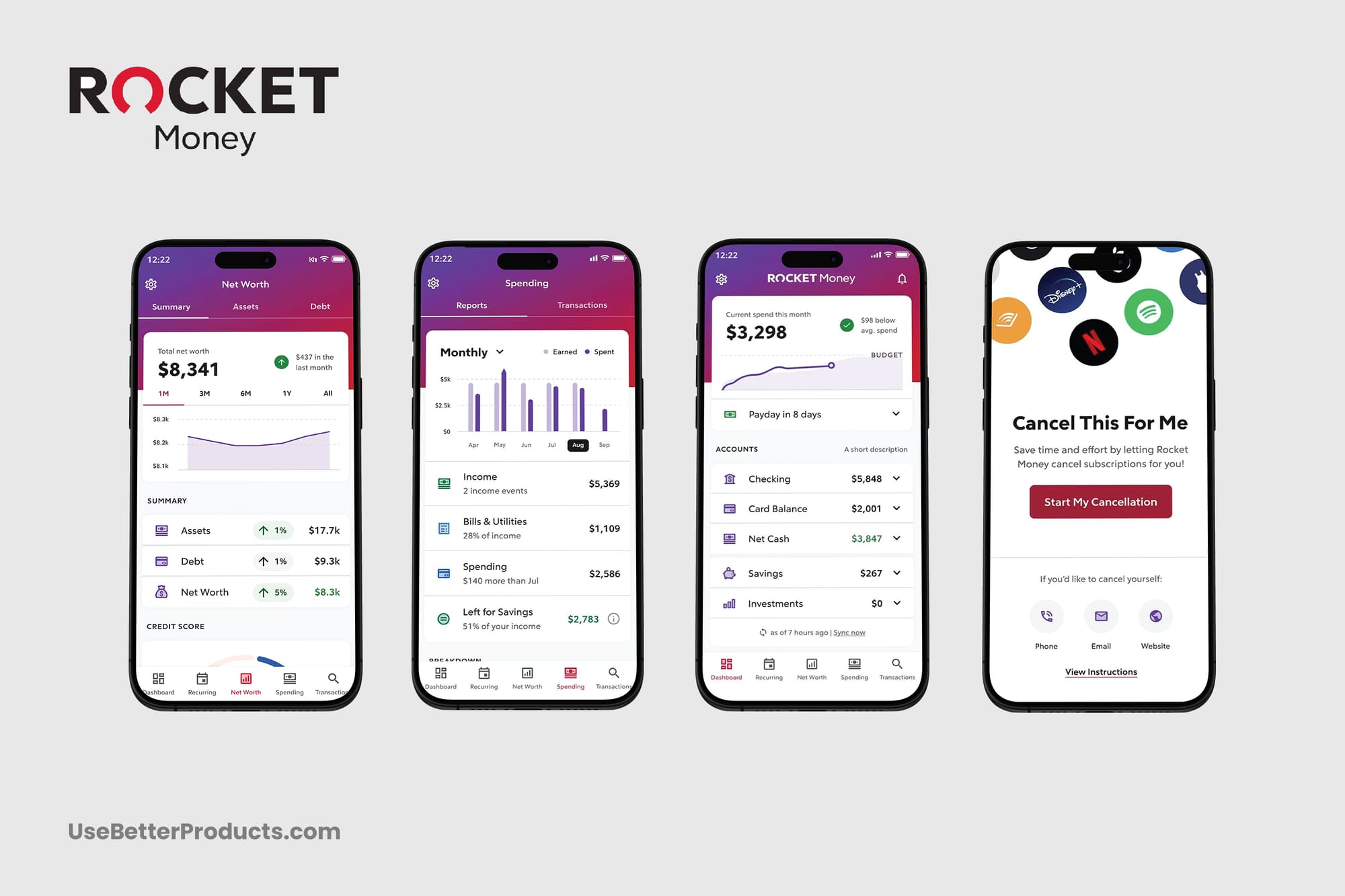

Rocket Money, formerly known as Truebill, is a powerhouse in the personal financial app arena. Born out of the frustration of tracking subscriptions and managing monthly expenses, Rocket Money offers various tools to help people take control of their finances with minimal hassle.

At its core, Rocket Money is a subscription management and automatic budgeting app that tracks all spending and recurring payments, identifies unused or forgotten subscriptions, and assists in canceling them with just a few taps.

But over time, Rocket Money has expanded beyond just subscription management. They now offer multiple budgeting and personal finance tools that automatically categorize and analyze spending, and then provide clear insights into where money goes each month. With their bill negotiation service, the app also helps users identify, cancel, or negotiate better rates - automatically.If you’re looking for a Mint.com replacement to help track income, spending, and your net worth over time; this is easily our top choice.

Pros

Expense Tracking and Budgeting:

- Abundant Insights: Rocket Money provides detailed breakdowns of users’ spending, helping them understand and control where their money goes.

- Customizable Budgets: Users can create and manage custom budgets tailored to their financial goals.

- Net worth tracking: Monitor accounts across many different providers from a central dashboard.

Subscription Management:

- Automatic Tracking: Rocket Money automatically tracks and categorizes all users’ subscriptions, making it easy to see what they’re paying for each month.

- Easy Cancellation: The app offers a simple way to cancel unwanted subscriptions, saving both time and money.

Bill Negotiation:

- Potential Savings: Rocket Money can negotiate better rates on bills, potentially saving significant amounts on recurring expenses.

- Hassle-Free: The negotiation process is handled entirely by the app, requiring minimal effort on users’ part.

- User-Friendly Interface:

- Intuitive Design: The tool is designed to be user-friendly, with an intuitive interface that makes financial management less daunting.

- Security:

- Strong Encryption: Rocket Money uses solid encryption techniques to protect financial data.

- Privacy Commitment: Clear privacy policies outline how personal data is used and protected.

Cons

Cost:

- Subscription Fees: While the basic version is free, premium features require a subscription fee of between $6-12/month.

- Value: Some users may find the cost of the premium version outweighs the benefits, especially if they do not take advantage of all the features.

Bank Integration Issues:

- Syncing Problems: Occasionally, users report issues with syncing their bank accounts, leading to inaccurate data.

- Limited Bank Support: Not all banks and financial institutions are supported, limiting the app’s usefulness.

Customer Support:

- Response Time: Some users have noted that customer support is slow to respond to inquiries and issues.

- Support Quality: The quality of customer support can vary, with some users experiencing less satisfactory resolutions.

Features:

- Spending Analysis & Optimization Only: Limited to only Spending Analysis and Optimization. Limited products and features for Investment, Spending, etc. Would be nice to see integrated investments, crypto, bill payment, etc.

Price

- Free Version: The free version of Rocket Money includes essential features such as basic subscription management, expense tracking, and limited budgeting tools.

- Premium Subscription: The premium subscription is $6 per month, but can go higher depending on tier. The premium version unlocks additional features including Advanced Subscription Management, Bill Negotiation Services, Credit Report Monitoring, and Automatic Subscription Cancelation.

Overall, Rocket Money is a reliable personal finance app that excels in subscription management and offers valuable tools for budgeting and bill negotiation. Its user-friendly interface makes it an attractive option for those looking to streamline their financial management and cut unnecessary expenses.

However, Rocket Money is not without its drawbacks. The premium features come at a cost, which may not be justified for all users. Occasional syncing issues with bank accounts and varying customer support experiences can also detract from the overall user experience. Despite these challenges, Rocket Money remains a powerful tool for anyone serious about gaining control over their finances.

YNAB App Review

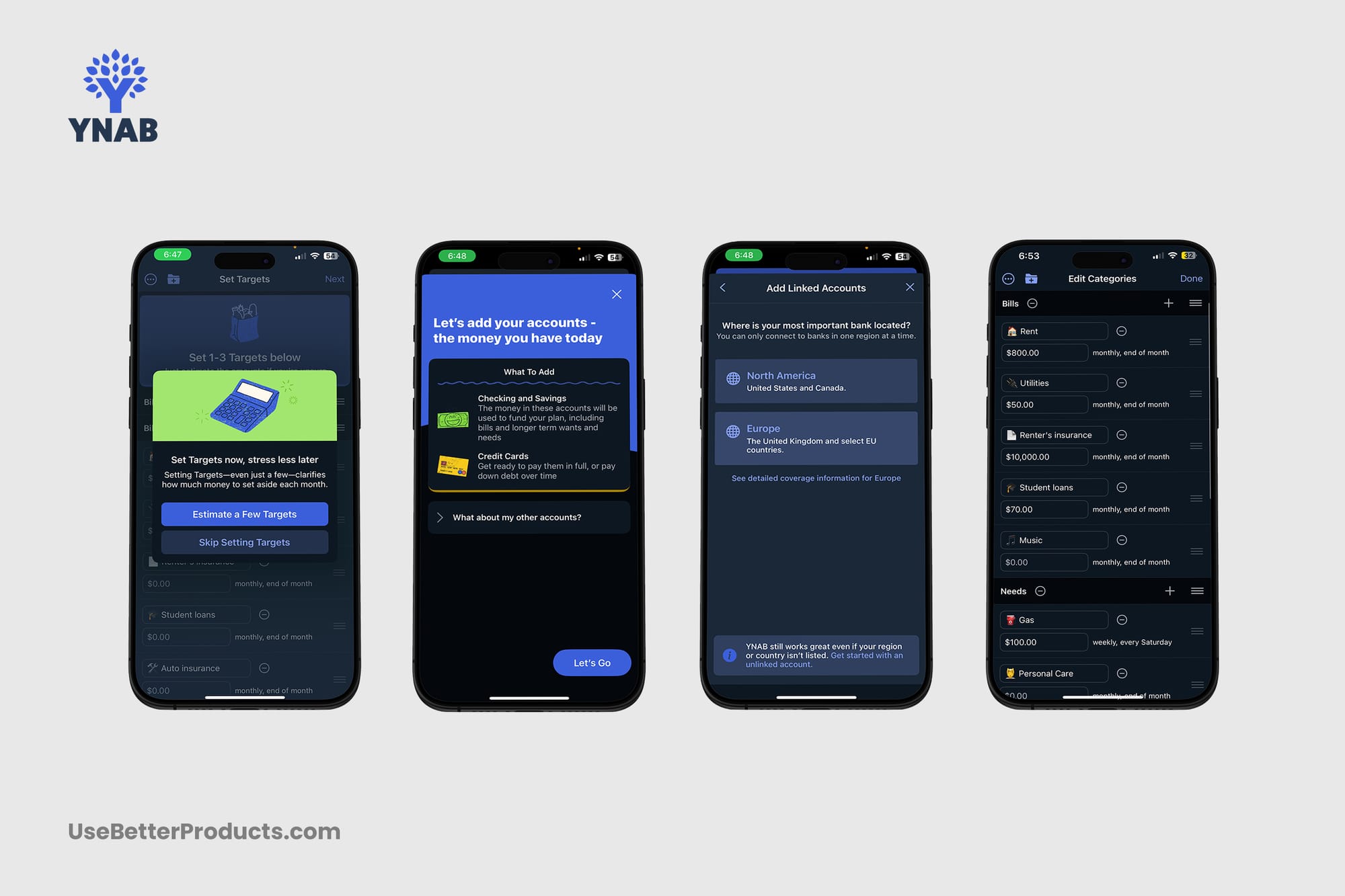

You Need a Budget (YNAB) is a personal finance app that has garnered a loyal following for its groundbreaking approach to budgeting. Unlike traditional budgeting tools that merely track spending, YNAB focuses on proactive money management. This philosophy is rooted in YNAB’s Four Rules: Give Every Dollar a Job, Embrace Your True Expenses, Roll with the Punches, and Age Your Money.

YNAB’s key offerings include a web app and mobile apps for iOS and Android, creating a seamless experience across devices. Additionally, YNAB provides extensive educational resources, including workshops, video tutorials, and a supportive community forum. The educational content sets YNAB apart as not just a budgeting app but a well-rounded financial wellness platform.

Pros

Proactive Budgeting Approach:

- Forward-Thinking: YNAB encourages users to plan ahead, helping allocate funds for future expenses and prioritize financial goals.

- Financial Stability: The tool can lead to better financial stability if it’s well utilized.

Educational Resources:

- Extensive Content: It offers live workshops, video tutorials, and a supportive online community to help users grasp budgeting principles.

- User Support: The app provides continuous learning opportunities to enhance financial literacy.

Multi-Device Syncing:

- Flexibility: YNAB’s seamless synchronization across web, iOS, and Android platforms allows seamless budget access.

- Convenience: The tool ensures that financial management is adaptable to users’ lifestyles.

Detailed Reporting and Goal Tracking:

- In-depth Analysis: YNAB offers detailed spending reports and goal tracking to monitor financial progress.

- Informed Decisions: Users can make better financial decisions based on plenty of data.

Bank Syncing:

- Automatic Updates: The app simplifies keeping budgets up-to-date by importing bank transactions automatically.

- Reduced Errors: It minimizes manual entry and potential errors.

Cons

Subscription Cost:

- Ongoing Fees: YNAB requires a monthly or annual subscription, which might be a barrier for some users compared to free budgeting tools.

- Cost Consideration: Users must evaluate if the cost justifies the benefits offered.

Learning Curve:

- Initial Challenge: The YNAB method can take time to master, potentially challenging new users.

- Setup Difficulty: The app’s initial setup and transitioning from traditional budgeting methods may be complex.

Limited Investment Tracking:

- Niche Focus: YNAB lacks detailed investment tracking and financial planning features, requiring additional tools for better financial management.

- Additional Tools Needed: Users may need to supplement with other apps for full financial oversight.

Manual Adjustments Needed:

- Time-Consuming: Despite YNAB’s bank syncing, users may have to manually categorize transactions.

- Effort Required: Users might find this process time-consuming.

No Bill Pay Feature:

- Separate Management: YNAB does not offer a bill pay feature, which forces users to handle payments separately.

- Feature Gap: Users need to find other methods to manage bill payments within their financial routine.

Price

- Free Trial: YNAB provides a 34-day free trial period, allowing users to test out the app’s features and interface without any financial commitment.

- Monthly Subscription: The monthly subscription costs $14.99 per month. This plan includes access to all YNAB features such as detailed budget tracking, multi-device syncing, and educational resources.

- Annual Subscription: The annual subscription is priced at $98.99 per year, which averages out to approximately $8.25 per month. This plan makes it a cost-effective option for users who are confident in their long-term use of the app.

YNAB stands out as a powerful tool for individuals serious about taking control of their finances. The app’s multi-device compatibility, easy bank syncing, and detailed reporting features ensure that users have a convenient budgeting experience.

However, potential users should be aware of the subscription cost and the initial learning curve associated with adopting YNAB’s methodology. Despite the downsides, YNAB is still a worthwhile investment for those committed to improving their financial health.

Coinbase App Review

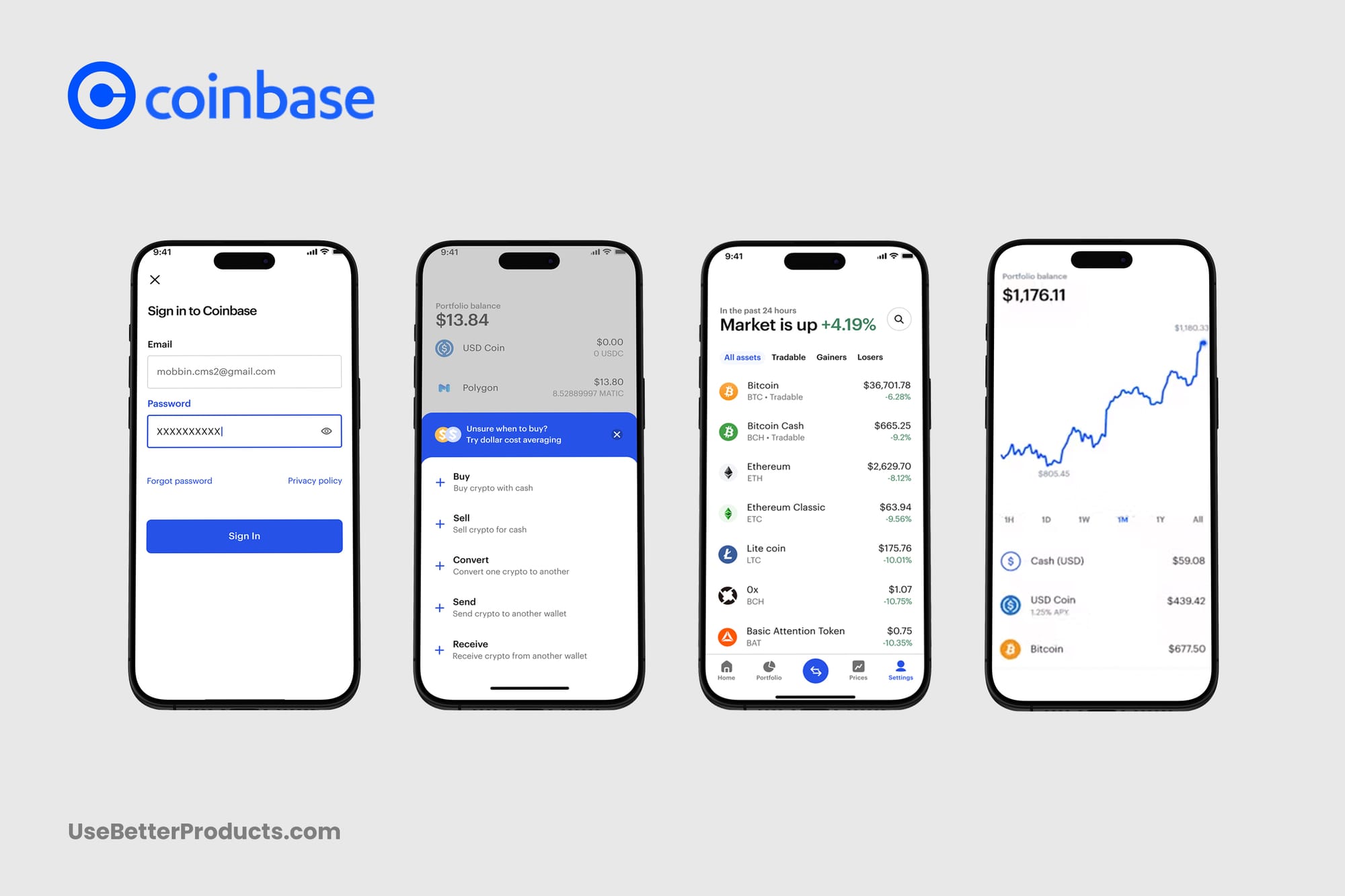

Coinbase is a premier cryptocurrency exchange platform that seamlessly integrates into personal financial management, making it easier for individuals to diversify their financial portfolios with digital assets. The platform supports a variety of digital currencies, including Bitcoin, Ethereum, and Litecoin, providing users with ample opportunities to expand and diversify their investments.

Key offerings on Coinbase include a streamlined process for buying and selling cryptocurrencies, access to real-time market data, and an intuitive mobile app that facilitates on-the-go trading. For those seeking more advanced trading options, Coinbase Pro offers sophisticated tools and lower transaction fees.

Pros

User-Friendly Interface:

- Easy to Navigate: Coinbase offers a clean, intuitive interface that simplifies the process of buying, selling, and managing cryptocurrencies, making it suitable for beginners.

- Mobile App: The Coinbase mobile app allows users to manage their crypto investments on the go, ensuring seamless access to their accounts 24/7.

Robust Security Features:

- Secure Wallet: The tool provides a secure digital wallet to protect users' assets from potential threats.

- Regulatory Compliance: Coinbase is committed to regulatory compliance, enhancing trust and security for users.

Educational Resources:

- Learning Tools: The app offers a variety of educational resources to help users understand the complexities of cryptocurrency investing.

- Guided Experience: Coinbase’s tutorials and articles guide new users through the process of buying and managing digital assets.

Diverse Cryptocurrency Support:

- Wide Range of Assets: Coinbase supports a broad spectrum of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, allowing for diversified investment portfolios.

- Advanced Trading Options: Coinbase Pro provides advanced traders with detailed charting tools and lower fees for more sophisticated trading strategies.

Convenient Features:

- Recurring Buys: Users can set up recurring buys to automate their investment process.

- Price Alerts: The app allows users to set price alerts for specific cryptocurrencies, keeping them informed of market changes.

Cons

Transaction Fees:

- High Fees: Coinbase charges relatively high fees for buying and selling cryptocurrencies, which can eat into investment returns.

- Cost Structure: The fee structure may be confusing for new users, and lower-fee alternatives might be more appealing for frequent traders.

Limited Customer Support:

- Support Response Time: Some users have reported slow response times from customer support, which can be frustrating.

- Support Quality: The quality of customer support can vary, with some users experiencing less satisfactory resolutions.

Privacy Concerns:

- Data Handling: Like other financial tools, concerns about how personal data is managed and shared may arise.

- Transparency: Users need to be comfortable with the level of access Coinbase has to their financial information.

Bank Integration Issues:

- Syncing Problems: Occasionally, users report issues with syncing their bank accounts, leading to delays or inaccuracies in transactions.

- Limited Bank Support: Not all banks are supported, which can limit the app’s usefulness.

Learning Curve for Advanced Features:

- Complexity: While Coinbase is user-friendly, mastering its more advanced features, particularly on Coinbase Pro, can be challenging for newbies.

- Initial Setup: Setting up and understanding the full range of features might require additional effort.

Price

- Transaction Fees: Coinbase charges fees for buying and selling cryptocurrencies, which can range from 0.50% to 4.00% depending on the payment method and transaction size.

- Coinbase Pro: This platform offers lower fees for higher volume trading, with fees starting at 0.50% and decreasing as trading volumes increase.

- Other Fees: Coinbase also imposes additional fees for services like recurring buys, instant card withdrawal, and other specialized transactions.

Coinbase is a versatile platform for individuals looking to incorporate cryptocurrency into their financial toolkit. The ability to support a wide range of cryptocurrencies and provide advanced trading options through Coinbase Pro further enhances the tool’s appeal to more experienced investors.

Despite Coinbase’s benefits, potential users should be mindful of the relatively high transaction fees and occasional customer support challenges. Mastering the app’s advanced features may also require some time. Still, even with these drawbacks, Coinbase remains a top choice for those seeking a reliable platform to navigate the dynamic landscape of cryptocurrency.

Wise App Review

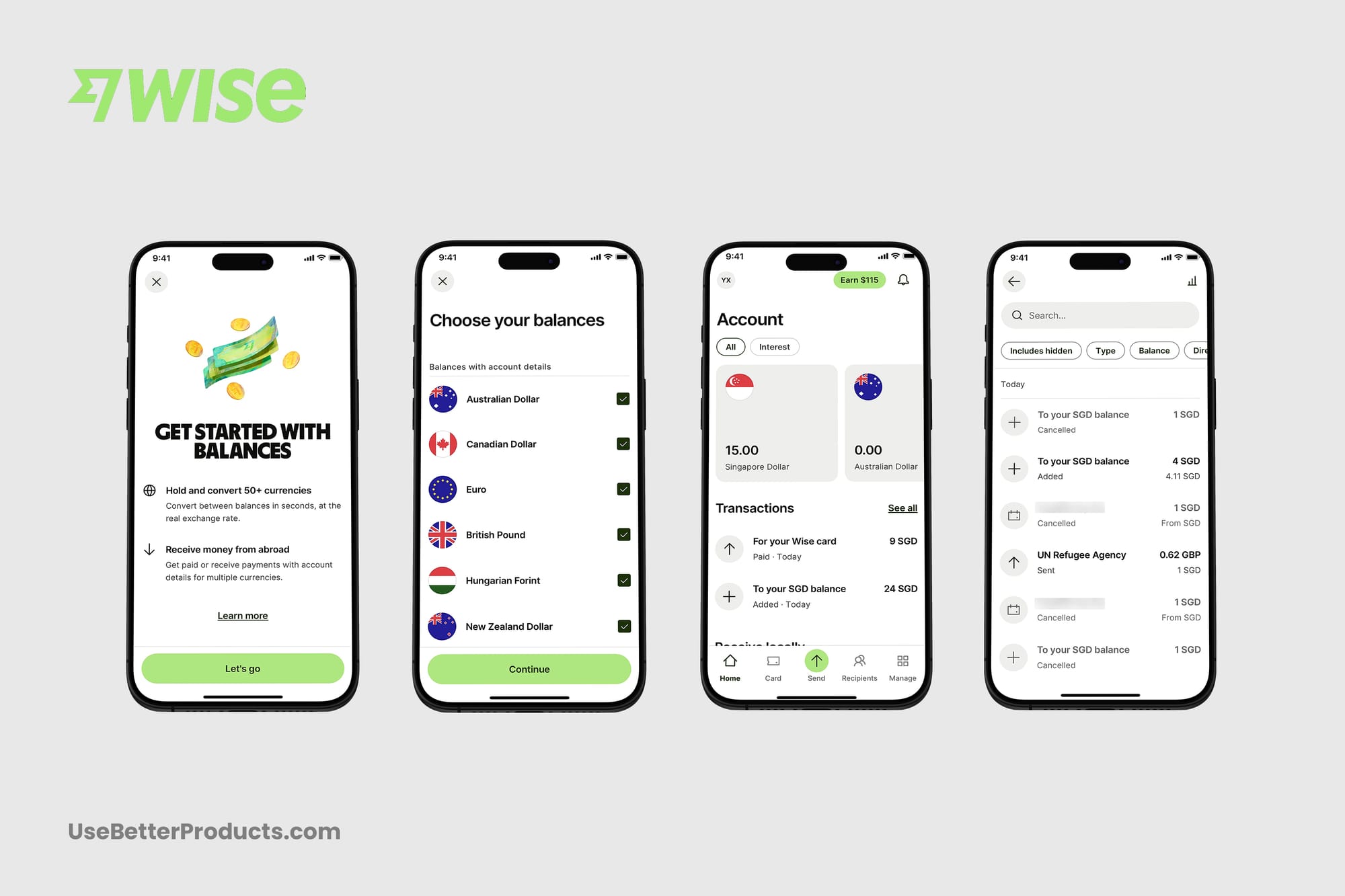

Wise, formerly TransferWise, is an advanced personal financial app with an innovative approach to international money management. Catering to frequent travelers, expatriates, and anyone needing to handle multiple currencies, Wise offers a cost-effective and transparent platform for international money transfers. By using the real exchange rate and charging minimal fees, Wise ensures users get the best value for their money, significantly undercutting traditional banking fees.

As a personal financial tool, Wise's standout features include its multi-currency account, allowing users to hold funds in over 50 currencies seamlessly. This feature is perfect for those who need to juggle multiple currencies without the hassle of high conversion fees. With Wise, users have a great tool to optimize and improve their international financial management.

Pros

Cost-Effective Transfers:

- Low Fees: Wise charges minimal fees for international money transfers, which is significantly lower than traditional banks.

- Real Exchange Rates: The app uses the real exchange rate with no hidden markups, ensuring users get the best possible value for their money.

Multi-Currency Management:

- Multi-Currency Account: Wise users can hold and manage funds in over 50 currencies, making it ideal for expatriates and international travelers.

- Seamless Currency Conversion: Wise enables easy conversion between currencies at low cost, avoiding the high fees typically charged by banks.

Convenient Debit Card:

- Global Spending: The Wise debit card is linked to their multi-currency account, allowing users to spend globally with real-time exchange rates.

- Local-Like Spending: The app lets you spend like a local in various countries, reducing the hassle of currency exchange.

User-Friendly Interface:

- Ease of Use: The app’s intuitive design makes managing international finances straightforward, even for those new to multi-currency accounts.

- Real-Time Tracking: Wise offers real-time exchange rate tracking, helping users make informed financial decisions.

Transparent and Secure:

- Clear Fee Structure: Wise’s transparent fee structure ensures users always know what they are paying, with no hidden charges.

- Strong Security Measures: The app’s security protocols protect users' funds and personal information.

Cons

Transfer Speed:

- Variable Transfer Times: While many transfers are quick, some can take longer depending on the destination country and payment method used.

- Potential Delays: Transfers involving certain currencies or banking systems can occasionally face delays.

Limited In-Person Support:

- No Physical Branches: Wise operates entirely online, which may be a drawback for users who prefer in-person customer service.

- Customer Support: Some users have reported slow response times from customer support, especially during peak times.

Usage Limitations:

- Card Availability: The Wise debit card is not available in all countries, limiting its use for some potential customers.

- Cash Deposits: The service does not support cash deposits, which may be inconvenient for users who frequently deal with cash.

Dependent on Internet Access:

- Online Only: All account management is conducted online, which may be limiting for those with unreliable internet access.

- App Dependence: Users must rely on the app or website for all transactions and management.

Initial Setup:

- Verification Process: The initial setup and verification process can be time-consuming, requiring users to provide extensive documentation.

- Learning Curve: Newbies may need time to fully utilize all the features, especially if they’re unfamiliar with multi-currency accounts.

Price

- Transfer Fees: Wise charges minimal fees for international money transfers, which are significantly lower than traditional bank fees. The exact fee depends on the amount and the destination.

- Exchange Rates: Wise uses the real exchange rate, also known as the mid-market rate, without any hidden markups.

- Receiving Money: Free to receive money in several major currencies like USD, EUR, GBP, and AUD.

- Currency Conversion: A small fee is charged for converting money between currencies, typically a percentage of the amount being converted.

- Additional Services Fees: Wise offers other services like borderless accounts and international business payments, each with its own fee structure.

Wise stands out as a revolutionary personal financial tool for anyone managing money across borders. Its low real exchange rates and ability to manage funds in multiple currencies make it a valuable asset for frequent international travelers.

Still, be wary of the potential transfer delays. Also, the reliance on online platforms may not suit everyone's needs. Despite these minor drawbacks, Wise’s many features make it a powerful app for anyone looking to enhance their international financial transactions.

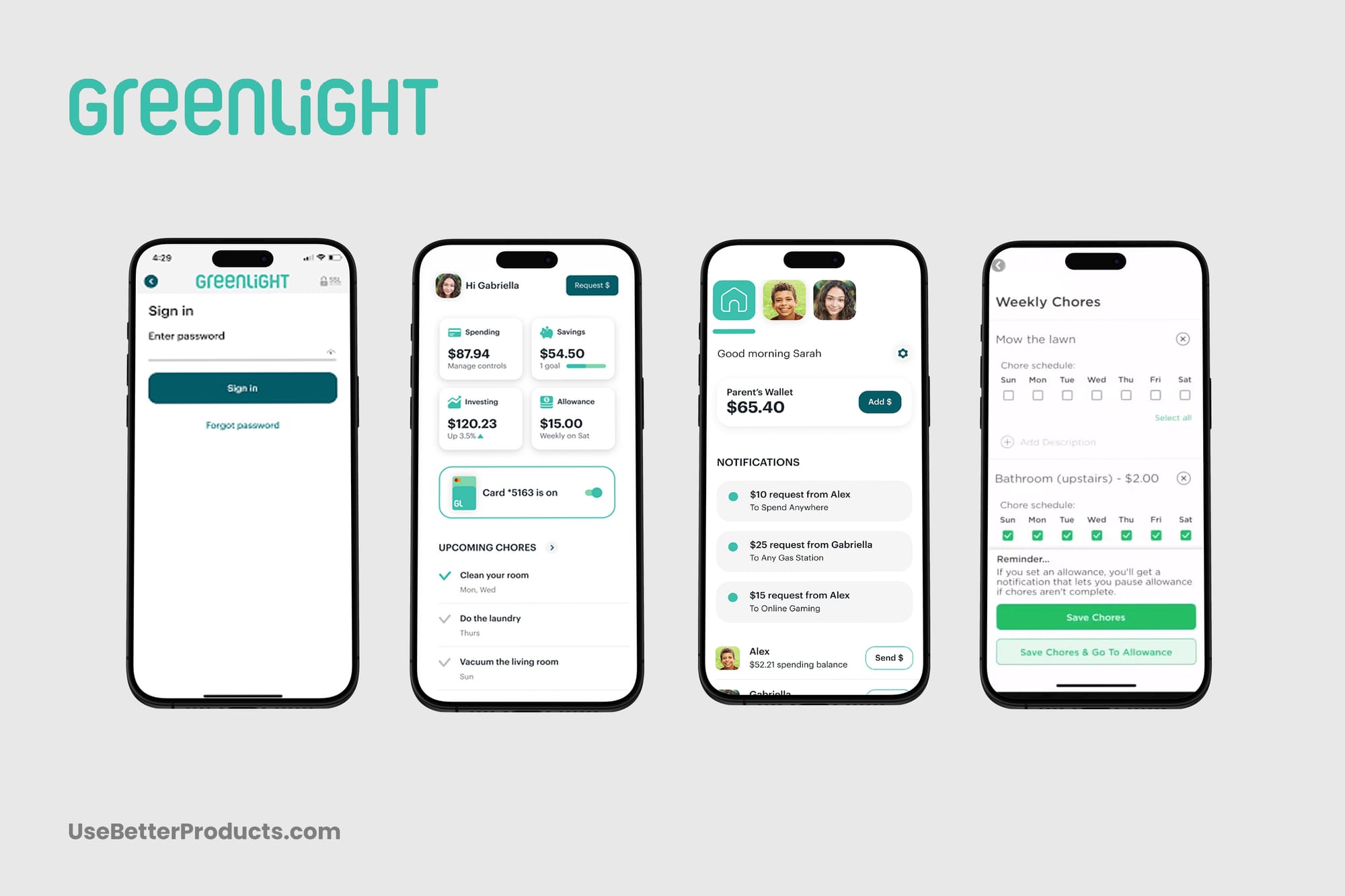

Greenlight App Review

Greenlight is an innovative personal financial tool designed to teach kids and teens about money management in a practical way. Recognized for its family-centric approach, Greenlight offers a suite of features that allow parents to oversee their children’s financial activities while providing a safe learning environment.

Key offerings of Greenlight include the ability for parents to set up and fund debit cards for their children, complete with real-time notifications and spending controls. The app also enables kids to set savings goals, learn about investing through a kid-friendly investment platform, and track their earnings from chores or allowances.

Pros

Financial Education for Kids and Teens:

- Practical Learning: Greenlight provides a hands-on approach to teaching financial literacy at a young age.

- Early Habits: The app instills good financial habits, promoting long-term financial responsibility.

Parental Controls and Oversight:

- Customizable Controls: Parents can set spending limits, approve transactions, and receive real-time notifications of their children's spending.

- Safety and Security: Greenlight provides a safe environment for kids to learn about money management with parental guidance.

Well-rounded Features:

- Customizable Debit Cards: Kids can use personalized debit cards funded by parents, making it easy for them to spend and save money responsibly.

- Chore Tracking and Allowances: The app lets parents assign chores and manage allowances, helping kids learn the value of earning money.

- Savings Goals and Investments: Kids can set and track savings goals and even learn about investing on a kid-friendly platform.

Educational Resources:

- Interactive Tools: Greenlight provides educational resources and interactive features to enhance financial learning.

- Engaging Content: The tool offers engaging content that makes learning about money fun.

Cons

Subscription Cost:

- Monthly Fees: Greenlight requires a monthly subscription fee, which might be a barrier for some families.

- Cost Consideration: Families need to evaluate whether the benefits justify the ongoing cost.

Limited Investment Options:

- Basic Investment Platform: The investment platform is designed for beginners and may not offer the depth needed for more advanced learning.

- Additional Tools Needed: Serious investment education might require supplementary tools or resources.

Dependence on Parental Involvement:

- Ongoing Supervision: The app relies heavily on parental involvement, which might be a challenge for busy parents.

- Manual Management: Parents need to individually manage their child’s financial activities.

Technology Reliance:

- Device Access: Greenlight requires access to smartphones or tablets, which may not be suitable for all families.

- Technical Issues: There can be occasional technical glitches like syncing or connectivity issues, just like in any other app.

Age Limitations:

- Youth Focused: Greenlight is primarily designed for kids and teens, which may limit its usefulness for older teens or young adults seeking more advanced financial tools.

Price

- Greenlight Core Plan: At $4.99 per month, this plan includes basic tools for managing kids' finances. It provides features such as debit cards for kids, real-time notifications of spending, and parental controls..

- Greenlight + Invest Plan: For $7.98 per month, this plan adds features for investing and more advanced financial education.

- Greenlight Max Plan: Priced at $9.98 per month, this plan offers comprehensive tools including priority customer support, identity theft protection, and more extensive financial education resources.

Greenlight’s combination of customizable tools and a kid-friendly investment platform provides a holistic toolkit for young learners. The app’s strong emphasis on parental controls and oversight ensures that financial education occurs in a safe environment.

While Greenlight excels in providing introductory financial education, its investment platform may be too basic for advanced learners, and its reliance on technology may not suit all households. Despite these limitations, Greenlight is still a worthwhile pick.

Empower.com Vs Empower.me

When two prominent financial platforms, Empower.com and Empower.me, share the same name, distinguishing between them can be perplexing. Despite their identical names, these apps offer distinct features and cater to different financial needs. Empower.com excels in comprehensive financial planning and wealth management.

In contrast, Empower.me focuses on everyday financial management, providing practical tools for budgeting and expense tracking. The shared name between these two distinct platforms can lead to confusion, but understanding their unique offerings and target audiences can help users choose the right Empower for their needs. Let's discuss their unique strengths and help you find the right fit for your financial goals!

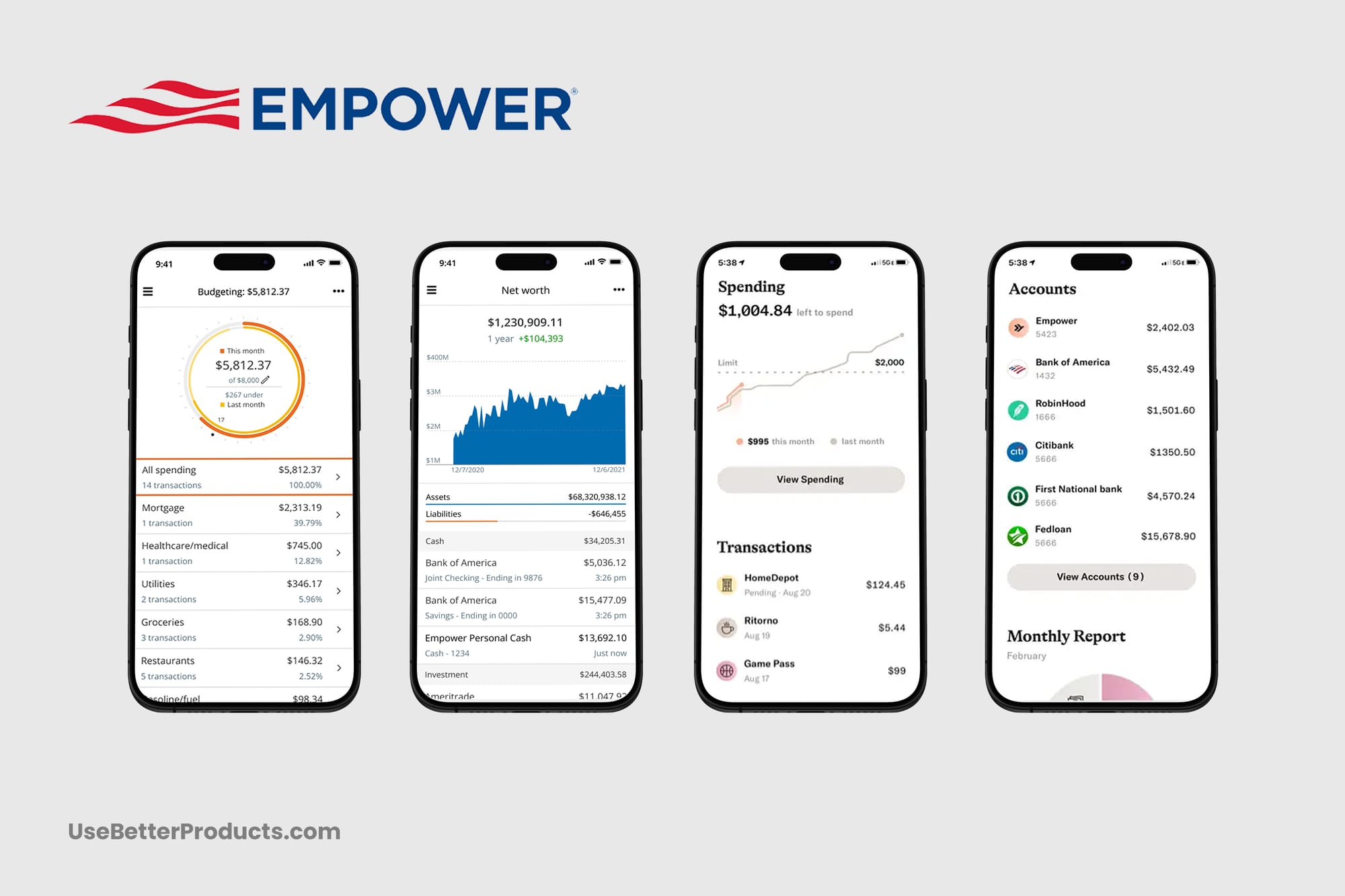

Empower.com App Review

Empower.com is a comprehensive financial planning and wealth management service. It offers tools for investment management, retirement planning, and detailed financial analytics. Their key product offerings include personalized investment strategies, retirement planning services, and a suite of financial planning tools that help users make informed decisions about their financial future. Empower.com aims to provide a holistic approach to wealth management, catering to individuals looking for a data-driven financial advisory service.

Pros

- Comprehensive Financial Planning: Empower.com offers tools for financial planning, including retirement planning, investment management, and detailed financial analytics.

- Personalized Investment Strategies: The platform provides personalized investment strategies tailored to users' financial goals, risk tolerance, and time horizon.

- Detailed Financial Analytics: Empower.com offers in-depth financial analytics and reporting tools. Users can gain insights into their financial health and make informed decisions based on data-driven recommendations.

- Retirement Planning Tools: The service excels in retirement planning, offering tools that help users project their retirement income and create a detailed plan to achieve their retirement goals.

- Holistic Approach to Wealth Management: It integrates various aspects of personal finance, including budgeting, saving, and investing, into a cohesive platform..

Cons

- Complexity for Beginners: Due to its comprehensive nature, it can be overwhelming for beginners or those with limited financial knowledge.

- Cost: Empower.com’s premium services and personalized financial advisory features come at a cost, which might be a barrier for some users..

- Limited Focus on Daily Budgeting: While Empower.com excels in wealth management and long-term financial planning, it may not be as strong in everyday budgeting and expense tracking.

- Data Integration Issues: Some users have reported issues with integrating and syncing financial data from various accounts, leading to inaccuracies in financial analytics.

- Accessibility: The platform’s comprehensive tools are primarily designed for users with substantial assets and complex financial needs.

Price

- Free Tools: Empower.com provides free financial planning tools and calculators, including budget tracking, net worth tracking, retirement planners, and investment checkups.

- Wealth Management Services: For users seeking personalized financial advisory services and comprehensive wealth management, Empower.com charges a percentage of assets under management (AUM):

- First $1 Million: 0.89% annual fee on assets managed.

- Next $2 Million: 0.79% annual fee on assets managed.

- Next $3 Million: 0.69% annual fee on assets managed.

- Next $5 Million: 0.59% annual fee on assets managed.

- Over $10 Million: 0.49% annual fee on assets managed.

Empower.com stands out as a comprehensive financial planning platform, ideal for individuals with substantial assets and complex financial needs. Its robust suite of tools for investment management, retirement planning, and detailed financial analytics makes it an excellent choice for those seeking a holistic approach to wealth management.

Still, the platform's complexity and cost may pose challenges for beginners or those looking for more straightforward, everyday budgeting solutions. Despite these drawbacks, Empower.com excels in providing personalized investment strategies and detailed financial insights, making it a top choice for serious investors and planners.

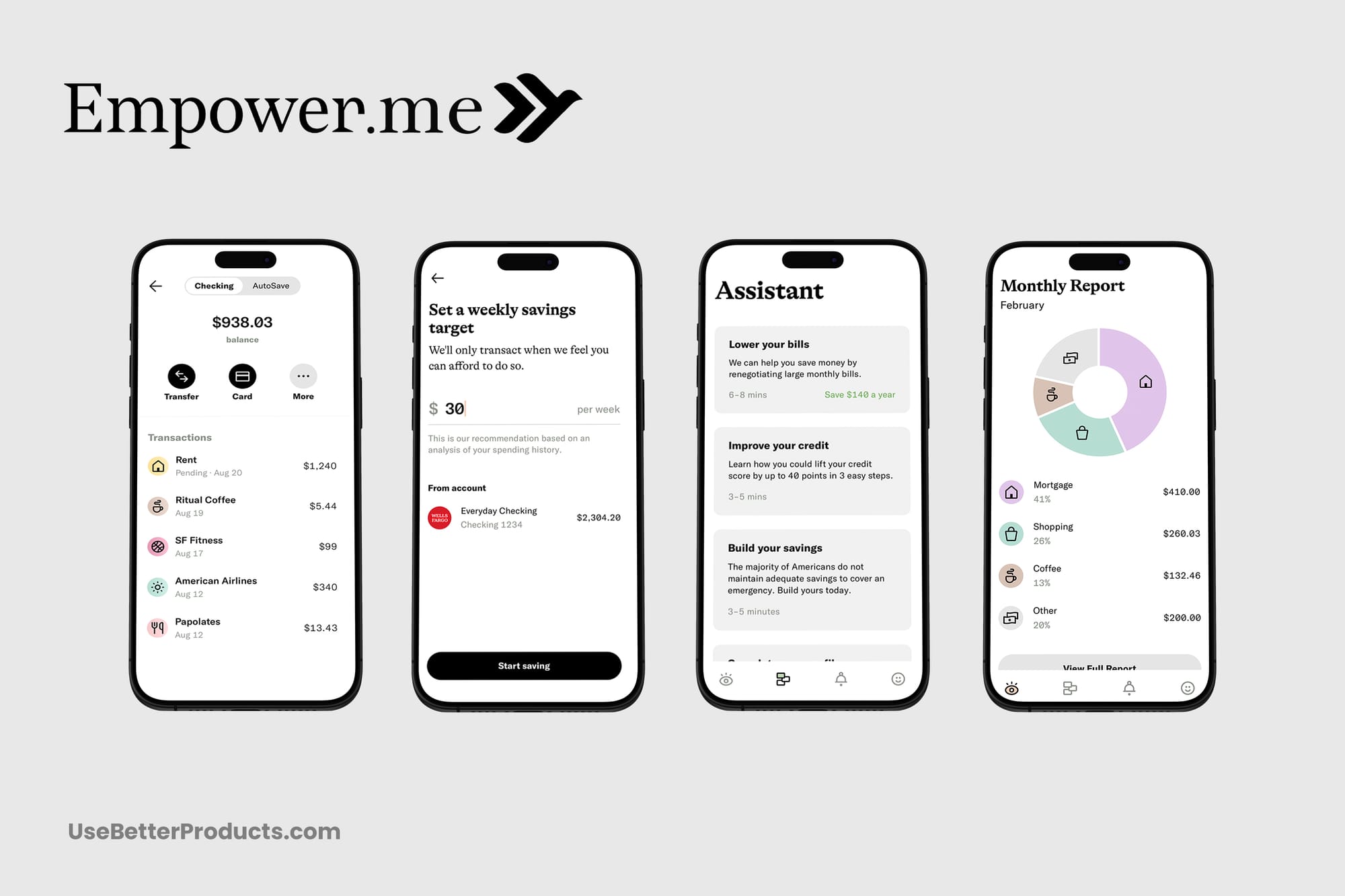

Empower.me App Review

Empower.me focuses on everyday financial management with a mission to enable users achieve their financial goals through practical, user-friendly tools. Empower.me offers features such as automatic transaction categorization, personalized financial recommendations, and a unique cash advance feature for unexpected expenses. This platform is designed to simplify budgeting, expense tracking, and overall money management for users who need a more straightforward financial assistant.

Pros

- User-Friendly Interface: Empower.me offers an intuitive interface that simplifies financial management for users of all levels.

- Automatic Transaction Categorization: The app automatically tracks and categories transactions, providing users with a clear view of their spending habits and helping them manage their finances effectively.

- Personalized Financial Recommendations: Empower.me offers tailored financial advice based on users’ spending patterns and financial goals.

- Cash Advance Feature: It includes a unique cash advance feature that provides users with quick access to funds for unexpected expenses.

- Subscription Management: The app helps users manage and track their subscriptions, making it easy to cancel unwanted services and save money.

- Real-Time Updates: Users receive real-time balance updates, ensuring that they always have an accurate picture of their financial situation.

Cons

- Subscription Cost: While Empower.me offers a free version, the premium subscription costs $8 per month or $96 per year.

- Limited Investment Tracking: Empower.me primarily focuses on budgeting and expense tracking, with limited tools for investment management.

- Potential Privacy Concerns: As with any financial app, there are concerns about how personal financial data is handled and shared.

- Bank Integration Issues: Some users have reported occasional issues with syncing their bank accounts, leading to inaccuracies or delays in financial data.

- Learning Curve: Despite its user-friendly interface, new users may still require some time to familiarize themselves to maximize the app’s benefits.

- Customer Support: Some users have noted slow response times from customer support, which can be problematic if issues arise.

Price

- Free Version: The free version includes basic budgeting tools, spending tracking, and financial insights. Users can track their expenses, view categorized transactions, and receive basic financial recommendations without any cost.

- Premium Subscription: Priced at $8 per month or $96 per year, the premium subscription offers additional features designed to enhance the user’s financial management experience. These range from Automatic Transaction Categorization and Cash Advance Feature to Enhanced Subscription Management and Priority Customer Support.

Empower.me is an intuitive financial management app that excels in providing practical tools for budgeting, expense tracking, and personalized financial recommendations. Its unique features, such as the cash advance option, make it a valuable tool for those looking to avoid high-interest debt.

Whereas the free version offers basic functionality, the premium subscription, priced at $8 per month or $96 per year, unlocks a more comprehensive suite of tools that can significantly enhance financial management. Despite the need for improved customer support, Empower.me remains a solid choice for users seeking accessible and effective personal finance management.

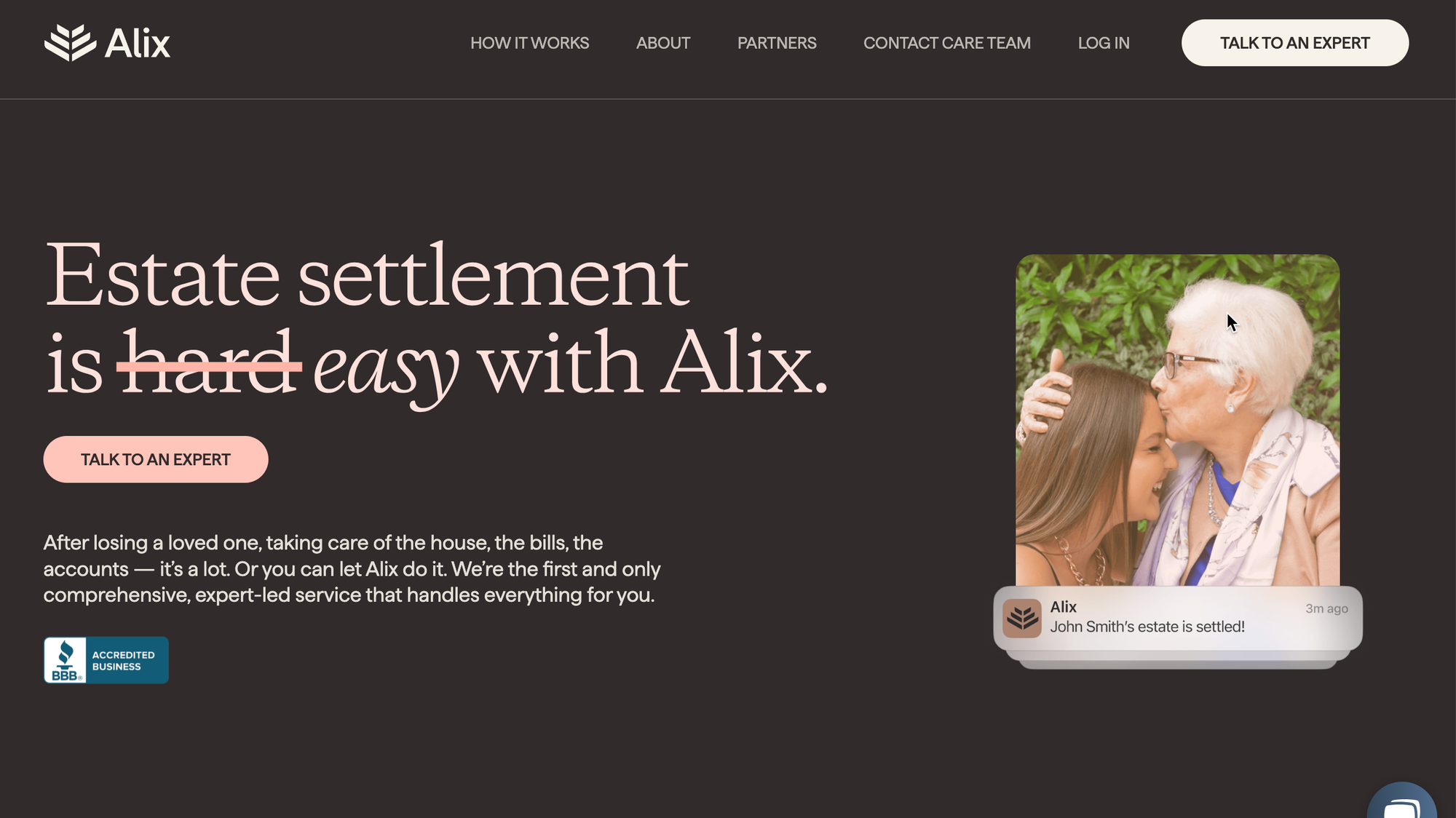

Alix App Review

Alix is an innovative personal financial app that utilizes artificial intelligence to provide users with personalized financial insights. Designed for people seeking to optimize their financial well-being, Alix offers a suite of features aimed at simplifying money management and improving financial decision-making.

The app’s top offerings include budget tracking, automatic expense categorization, and real-time financial health assessments. Alix’s AI-driven recommendations empower users to make informed financial choices, whether it's finding better savings opportunities or reducing unnecessary expenses. Additionally, Alix provides goal-setting tools and progress tracking, allowing users to monitor their financial milestones effectively.

Pros

- Comprehensive Estate Management: GetAlix.com offers a full suite of tools to manage and settle estates, including asset tracking, liability management, and legal document organization, making the process more streamlined.

- User-Friendly Interface: The platform is designed with ease of use in mind, offering an intuitive and straightforward interface that guides users through complex estate settlement tasks.

- Legal Compliance: GetAlix.com ensures that all steps of the estate settlement process comply with legal requirements, reducing the risk of errors and legal complications.

- Time-Saving Automation: The app automates many tasks involved in estate settlement, such as document generation and deadline reminders, which can save significant time and reduce stress.

Secure Data Handling: With robust security measures in place, GetAlix.com protects sensitive information, giving users confidence that their data is safe and secure.

Cons

- Cost: While GetAlix.com offers a powerful suite of tools, the subscription fees might be a barrier for some users, particularly those managing smaller estates or on a tight budget.

- App Availability: Only available as a web-app. Not available as a mobile app.

- Learning Curve: Although the interface is user-friendly, some users may still experience a learning curve, particularly if they are not familiar with estate management processes or technology.

- Limited Customization: The platform’s standardized processes may not fully accommodate unique or highly complex estates, requiring additional manual adjustments or legal consultation.

- Dependence on Internet Access: As an online platform, GetAlix.com requires a reliable internet connection, which could be a limitation for users in areas with poor connectivity.

Customer Support: Some users may find that customer support response times are slower during peak times, which could be frustrating when dealing with urgent estate settlement matters.

Price

- Varies

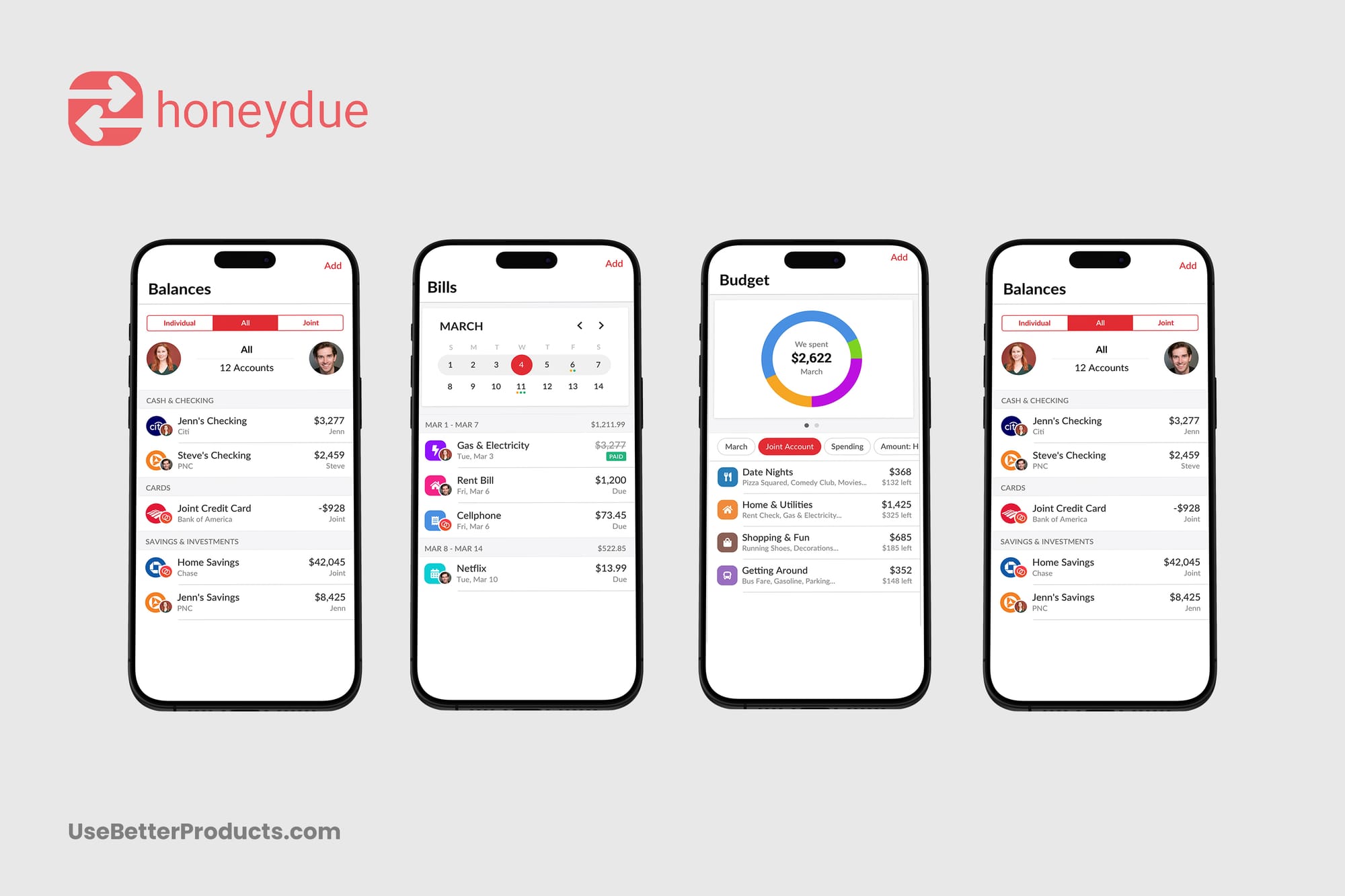

Honeydue App Review

Honeydue is a personal financial tool designed specifically for couples, aiming to simplify the complexities of managing shared finances. By providing a platform where partners can collaboratively manage their money, Honeydue helps couples stay on the same page financially. The app offers features such as joint budget tracking, bill reminders, and spending categorization, making it easier for couples to avoid the usual budgetary misunderstandings.

Key offerings of Honeydue include the ability to link multiple bank accounts, credit cards, and loans, providing a detailed view of both partners' finances in one place. The app also lets couples customize their budget categories, track spending in real time, and receive notifications for upcoming bills and transactions, fostering transparency.

Pros

Collaborative Financial Management:

- Joint Budget Tracking: Honeydue allows couples to track their spending together, providing a clear picture of their combined finances.

- Shared Goals: The app helps partners set and achieve financial goals collaboratively, promoting mutual accountability and understanding.

Account Integration:

- Multiple Account Linking: Honeydue supports the linking of multiple bank accounts, credit cards, and loans, offering a complete view of both partners' finances in one place.

- Real-Time Updates: With the tool, couples get real-time updates on transactions and account balances.

Bill Reminders and Notifications:

- Timely Alerts: The app sends notifications for upcoming bills, due dates, and recent transactions, helping couples avoid late fees and missed payments.

- Expense Categorization: Honeydue automatically categorizes spending, making it easier to manage expenses.

In-App Communication:

- Chat Feature: Honeydue includes a built-in chat feature that enables partners to discuss their finances directly within the app, promoting transparency.

- Ease of Use: The tool facilitates quick discussions about financial activities.

User-Friendly Interface:

- Intuitive Design: Honeydue’s intuitive design makes it easy for couples to navigate around their finances.

- Customizable Categories: The app lets partners create custom budget categories that cater to their specific needs.

Cons

Privacy Concerns:

- Data Sharing: Some couples may have concerns about sharing their financial information with their partner, which requires a high level of trust.

- Security: Just like other financial apps, there are potential security risks associated with linking bank accounts.

Limited Advanced Features:

- Basic Investment Tracking: Honeydue primarily focuses on budgeting and expense tracking, lacking advanced investment management or financial planning tools.

- Additional Apps Needed: Partners looking for many financial management tools might need to supplement Honeydue with other apps.

Dependency on Both Partners’ Participation:

- Mutual Involvement Required: The app’s effectiveness depends on both partners actively participating and keeping their information up to date.

- Potential for Imbalance: If one partner is less engaged, it can lead to an imbalance in financial management and decision-making.

Subscription Cost for Premium Features:

- Cost Consideration: While Honeydue offers a free version, some advanced features require a subscription, which might be a drawback for some couples.

- Value Evaluation: Partners need to assess whether the premium features are worth the subscription cost.

Technical Issues:

- Occasional Syncing Problems: Some users report occasional issues with syncing their bank accounts, leading to delays or inaccuracies in data.

- App Performance: There can be occasional glitches that affect the user experience.

Price

- Free Version: The free version includes most of the app’s core features such as joint budget tracking, bill reminders, and spending categorization.

- Premium Subscription: For $4.99 per month or $60 per year, the premium subscription unlocks additional features like unlimited bank accounts, the ability to export data, and enhanced security options.

Honeydue is an exceptional app for couples looking to streamline their financial management together. Its intuitive design and advanced features, including joint budget tracking and customizable spending categories, make it a useful tool for building financial transparency.

Nonetheless, couples should consider potential privacy concerns and the necessity for mutual participation to fully benefit from the app. Also, some advanced features require a subscription, which may be a consideration for budget-conscious users. Despite these shortcomings, Honeydue is the perfect choice for couples aiming to build a strong and united financial future.

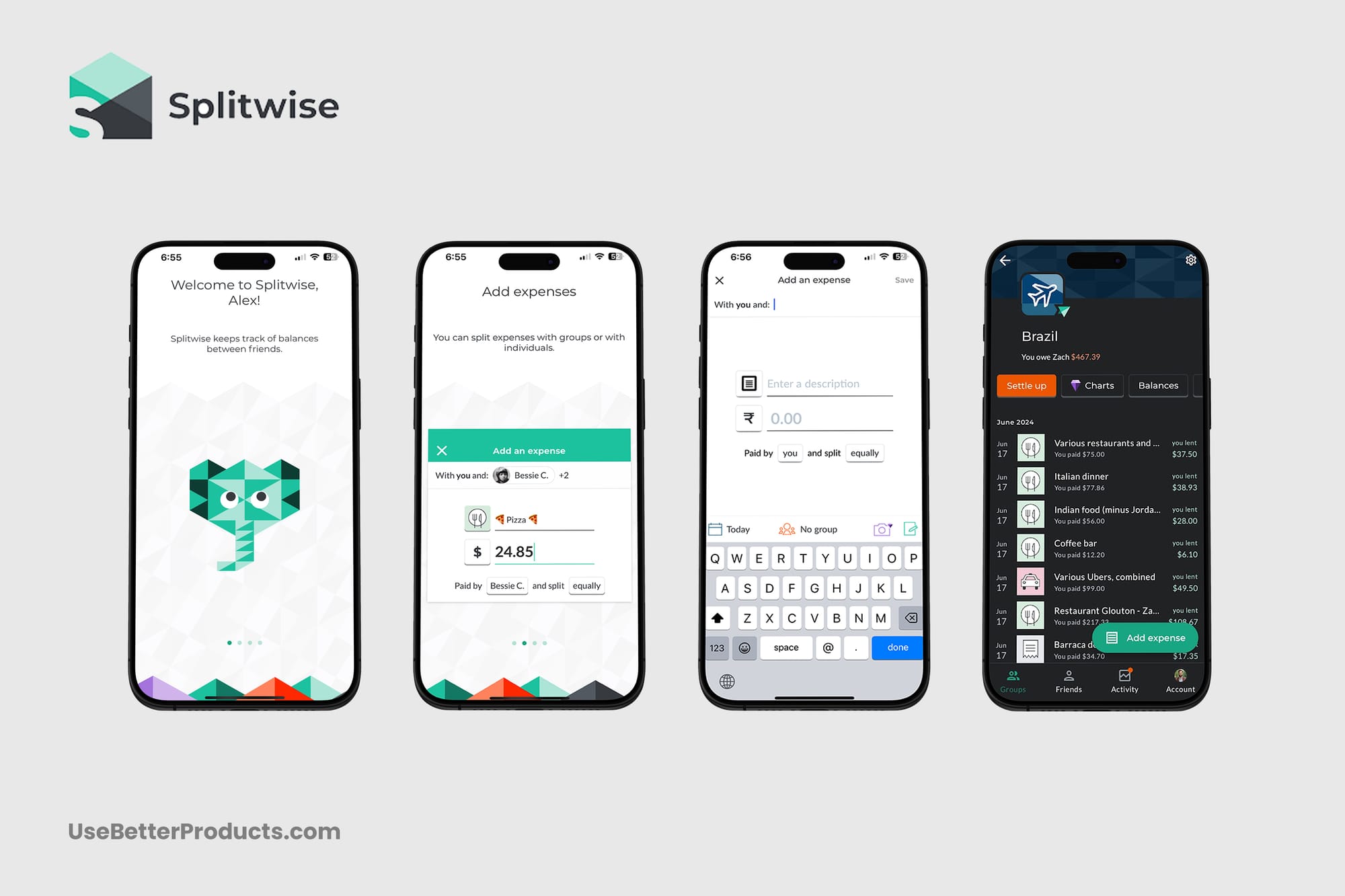

Splitwise App Review

Splitwise is a leading expense-sharing app designed to make splitting bills and managing shared expenses effortless. Ideal for roommates, friends, couples, and even colleagues, the app offers an intuitive interface where users can easily add expenses, split them among group members, and keep track of who owes whom, helping maintain financial harmony in any group dynamic.

Key offerings include creating groups for different types of expenses, such as rent, utilities, and travel costs. The app also supports multiple currencies, making it perfect for international use. Splitwise even integrates with popular payment platforms like PayPal and Venmo, allowing for seamless settlement of balances.

Pros

Simplifies Shared Expenses:

- Effortless Bill Splitting: The app easily splits bills among group members, ensuring everyone pays their fair share without complicated calculations.

- Group Creation: Splitwise lets users create different groups for various expenses, such as rent, utilities, or travel, keeping all financial responsibilities organized.

Customizable Splits:

- Flexible Options: Users can split expenses equally or customize amounts based on individual contributions, accommodating various financial arrangements.

- Detailed Expense Reports: Splitwise provides detailed reports on expenses and balances, making it easy to track debt.

Multi-Currency Support:

- International Usability: Splitwise supports multiple currencies, making it great during international travel or with friends and family abroad.

- Currency Conversion: The app automatically handles currency conversion, simplifying financial management across various currencies.

Payment Integration:

- Seamless Settlements: Splitwise integrates with popular payment platforms like PayPal and Venmo, allowing for quick and easy settlement of balances.

- One-Click Payments: Users can settle debts with a single click, reducing friction in managing shared expenses.

Recurring Expense Tracking:

- Automated Tracking: The app keeps track of recurring expenses, such as subscriptions, ensuring they are consistently divided among group members.

- Notification Alerts: Splitwise sends notifications to remind users of upcoming expenses, promoting timely payments.

Cons

Subscription Cost for Premium Features:

- Premium Fees: Some advanced features, such as receipt scanning and expense categories, require a subscription to Splitwise Pro.

- Cost Consideration: Users need to evaluate whether the extra cost justifies the premium features.

Privacy Concerns:

- Data Sharing: Sharing financial information within the app requires a certain level of trust among group members.

- Security: As with any financial app, there are potential security risks associated with handling personal financial data.

Dependency on Group Participation:

- Mutual Involvement Required: The app’s effectiveness relies on all group members actively participating and updating their expenses.

- Potential for Disputes: Inactive or uncooperative members can lead to imbalances and potential disputes over shared expenses.

Occasional Syncing Issues:

- Syncing Problems: Some users have reported occasional issues with syncing data across devices, which can lead to discrepancies in expense tracking.

- Technical Glitches: There can be occasional bugs or technical glitches that affect the user experience.

Learning Curve for New Users:

- Initial Setup: New users might find the initial understanding of the app’s features slightly challenging.

- Feature-Rich Complexity: While the app is user-friendly, mastering its full range of features may require some time.

Price

- Free Version: The free version includes the app’s core features, such as basic bill splitting, group expense management, and the ability to track balances.

- Splitwise Pro: For $3 per month or $30 per year, Splitwise Pro unlocks advanced features that enhance the app's functionality. These features include: Receipt Scanning, Expense Categories, Automatic Currency Conversion, Expense Search, and Backup to CSV

Splitwise is a must-have app for anyone who regularly shares expenses with others. Features like multiple groups and integration with payment platforms like PayPal and Venmo enhance its usability. Splitwise’s detailed expense reports also ensure transparency, avoiding payment conflicts in a group.

Group participants should, however, be aware of the subscription cost for accessing advanced features. Additionally, the app's effectiveness hinges on the active participation of all group members, which can sometimes be a challenge. Despite these minor drawbacks, Splitwise stands out as an invaluable tool for simplifying shared expenses.

Overall Conclusion

Exploring the world of personal financial tools can be overwhelming, but choosing the right app can make all the difference. And knowing the different capabilities and uses is the first step. This review provides a look at different tools’ unique features to help you pick one that fits your needs. From Rocket Money's subscription management and budgeting tools to YNAB's proactive money management philosophy, there's an option for everyone looking to take control of their finances.

Each app has its strengths and potential drawbacks, so the one you choose will depend on your financial goals and lifestyle. Whether you want to improve your budgeting, teach your kids about money, or navigate the complexities of cryptocurrency, there’s an app with the right features to transform your money management skills and help you achieve greater financial stability and peace of mind.