Last Updated: September 23, 2025

The best Mint replacement for most people is Rocket Money (automated bill tracking, subscription cleanup, and solid budgeting). If you want strict zero-based budgeting choose YNAB, and for households who want polished shared finances pick Monarch Money.

If Mint was your money HQ, the shutdown in March 2024 left a hole in your routine—and in your data. Intuit sunset Mint and pushed users toward Credit Karma, which still doesn’t offer Mint-style budgeting and spending trends; it focuses on credit monitoring and offers instead. That’s why this guide zeroes in on apps that actually replace Mint’s core features (and, in many cases, improve on them).

How we score (BP Score): 0–10 based on Budgeting & Planning (35%), Bank Connections & Reliability (20%), Net Worth & Investing (15%), UX & Mobile (15%), Automation & Extras (10%), Price-to-Value (5%).

TL;DR picks (with BP Scores)

- Best overall: Rocket Money — (8.9/10) — subscription tracking + bill negotiation + solid budgeting. Premium is “choose your price” ($75–$150/yr).

- Runner-up household pick: Monarch Money — (8.8/10) — polished collaboration and shared budgets ($99.99/yr).

- Best for zero-based budgeting: YNAB — (8.7/10) — the gold standard for envelope/zero-based budgeting ($109/yr).

- Best for “make it easy”: Quicken Simplifi — (8.5/10) — clean UI and cash-flow forecasting ($79/yr).

- Best spreadsheet power: Tiller — 8.4/10 — automatic feeds into Google Sheets/Excel ($79/yr).

- Best free for net worth + investments: Empower — (8.4/10) — excellent portfolio + net-worth tracking (free).

- Budget basic with debt tools: PocketGuard — (7.9/10) — “In My Pocket” guardrail; Plus plan adds power ($75/yr).

Everything We Recommend

| App | BP Score | Price (core) | Best For | Notable Strengths | Potential Trade-offs |

|---|---|---|---|---|---|

| Rocket Money | 8.9 | Free; Premium $75–$150/yr | Most people | Subscription tracking; bill negotiation; solid budgeting | Premium for full power; negotiation fee on savings |

| Monarch Money | 8.8 | $99/yr | Households & collaboration | Shared budgets; polished design | Paid; fewer “envelope” controls than YNAB |

| YNAB | 8.7 | $109/yr | Zero-based purists | Elite envelope method; education; habit-building | Learning curve; no native investing |

| Quicken Simplifi | 8.5 | $39/yr | Ease + cash-flow | Friendly UI; projected cash flow; watchlists | Investment tracking is basic; paid only |

| Tiller | 8.4 | $79/yr | Spreadsheet lovers | Bank feeds into Sheets/Excel; fully customizable | No dedicated mobile app; setup time |

| Empower | 8.4 | Free | Net worth & investments | Excellent portfolio + net worth; retirement tools | Budgeting is basic |

| PocketGuard | 7.9 | Free; Plus $75/yr | Debt payoff tracking | “In My Pocket” guardrail; debt plan | Advanced features require Plus |

How We Test & Decide

We’ve used Mint for years and now actively test its top replacements with real bank connections, recurring bills, and weekly reconciliation. We score each app on:

- Budgeting depth & speed: Goals, rollovers, mid-month course-correction

- Bank connections & reliability: Update speed, duplicate handling, coverage

- Net worth & investments: Brokerage/retirement linking, analytics, history

- Automation & quality-of-life: Subscriptions, bill negotiation, alerts, shared budgets, exports

- UX & mobile: Onboarding speed, clarity, friction

- Price-to-value: Cost vs. capability (and what you’d otherwise build manually)

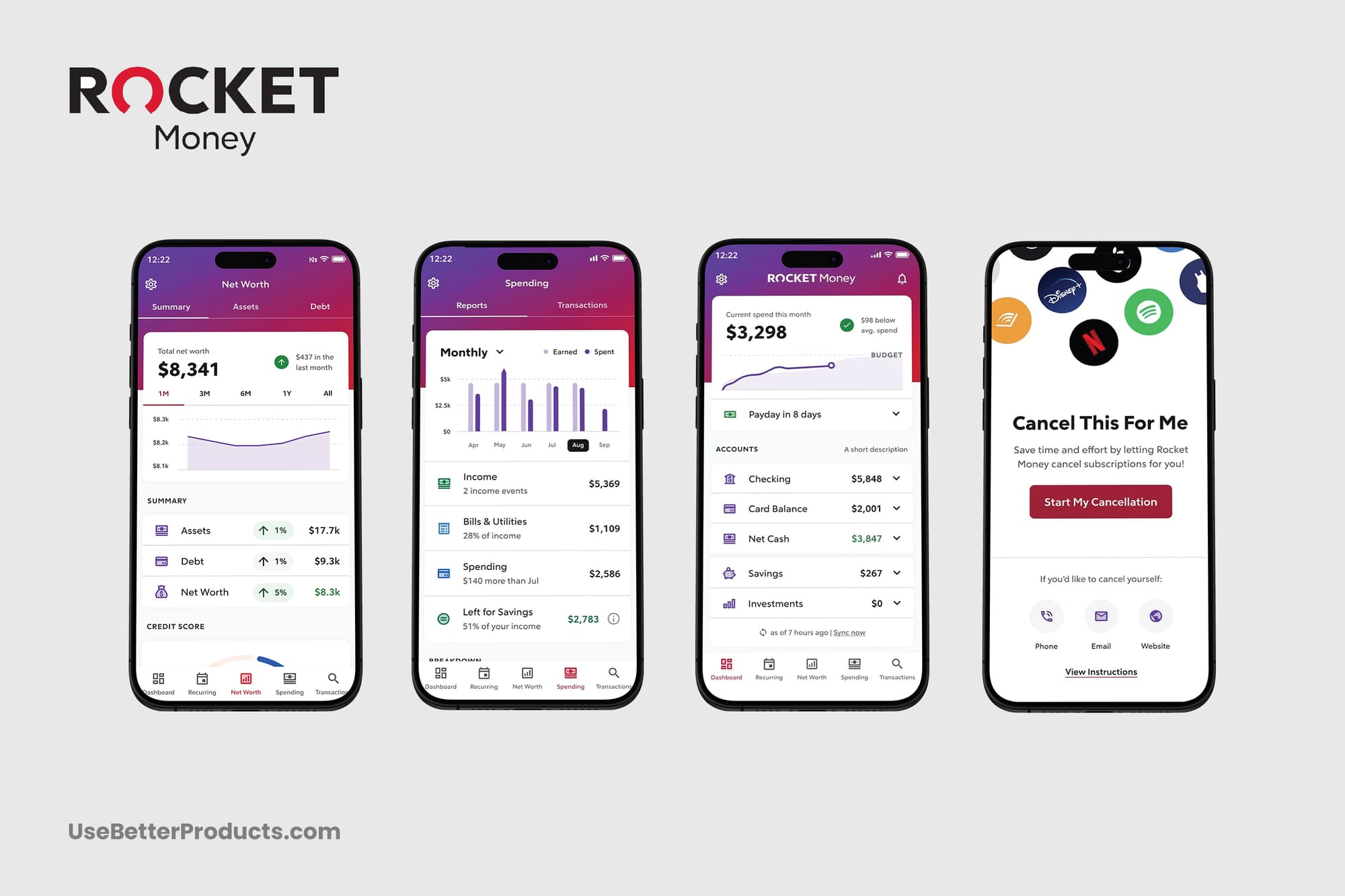

Best Overall: Rocket Money (formerly Truebill) — (8.9/10)

Why it wins: For most people, Rocket Money covers more real-life chores than any other single app. It auto-detects subscriptions, helps negotiate bills, builds budgets, tracks net worth, and even monitors credit—so you get both spend control and savings capture in one place. Premium is a choose-your-price model (typically $75–$150/yr), and the bill-negotiation service charges a percentage of first-year savings if successful.

What we loved

- Subscription radar + cancellation flows reduce “leaky bucket” spend

- Bill negotiation can find savings you’d never make time to chase

- Budgets and alerts are straightforward; setup takes minutes

Where it falls short

- Some advanced features sit behind Premium; negotiation savings incur a fee

Best for: Anyone who wants a one-stop Mint replacement that also saves money proactively—without spreadsheet tinkering.

Heads-up on negotiation fees: If you use bill negotiation, the service charges a success fee (a percentage of first-year savings that you choose within a set range). You’ll see the exact fee options before you confirm—skip it if you don’t want it.

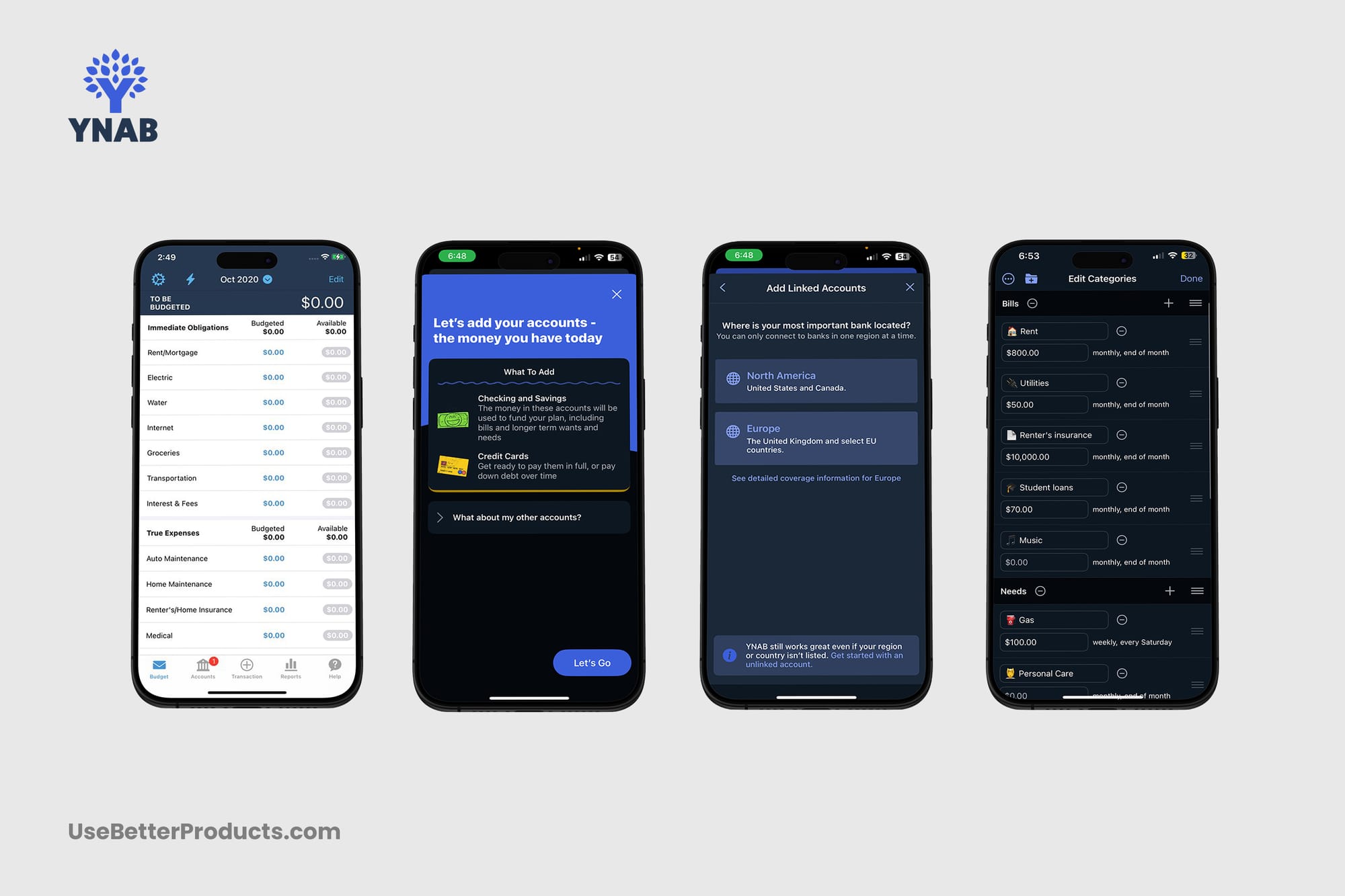

Best for Zero-Based Budgeting: YNAB — (8.7/10)

Why it’s great: YNAB is the discipline builder. If you want envelope/zero-based budgeting that forces intentionality, nothing beats it. Pricing is $109/year after a 34-day free trial. The payoff: superior cash control, goal pacing, and a community that actually teaches you to budget.

What we loved

- Class-leading zero-based method, category rollovers, ageing money

- Superb education (live workshops, guides) that change behavior

Where it falls short

- Learning curve if you’re new to “give every dollar a job”

- No native investment tracking—you’ll pair with Empower or your broker

Best for: People serious about behavior change and month-to-month control (couples do especially well here).

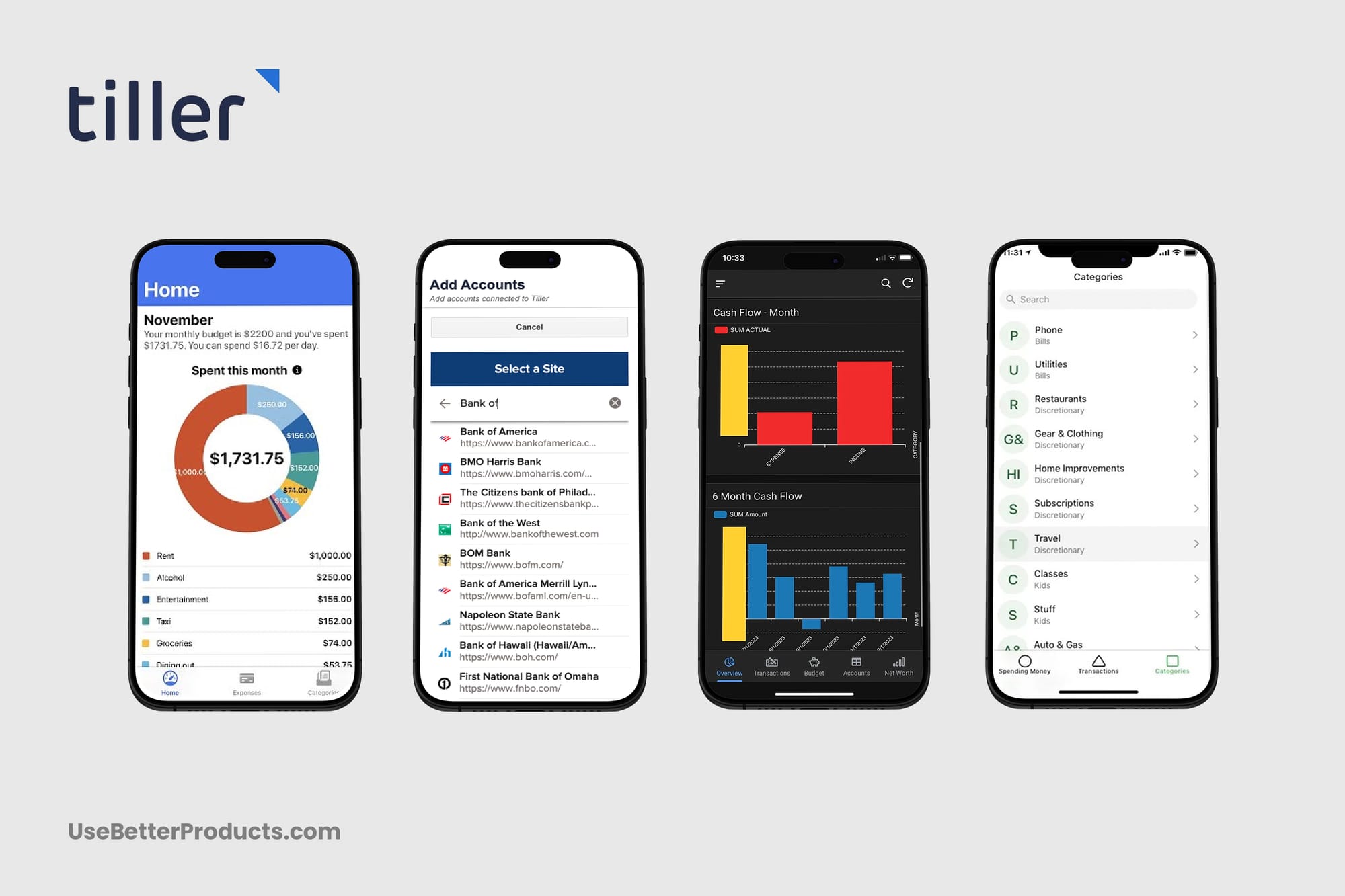

Best Spreadsheet Power: Tiller — (8.4/10)

Why it’s great: Tiller pipes your bank data into Google Sheets or Excel automatically, so you keep full control and build dashboards/reports exactly your way. It’s $79/year with a 30-day free trial. If you’ve ever tried to maintain a manual spreadsheet, this is that—but automated.

What we loved

- Templates for budgets, debt payoff, and net-worth; fully customizable

- Daily feeds + categories you control; great for power users and tax exports

Where it falls short

- No dedicated mobile app; there’s setup time and spreadsheet learning

Best for: Spreadsheet-comfortably-nerdy users who want precision and flexibility over a slick mobile UI.

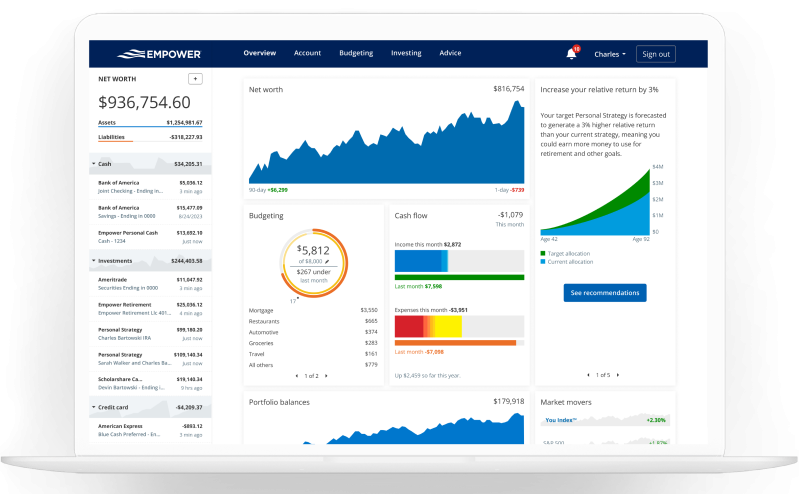

Best Free for Net Worth & Investing: Empower (formerly Personal Capital) — (8.4/10)

Why it’s great: If you loved Mint’s “big picture,” Empower’s free Personal Dashboard is better for investments + net worth than anything on this list. Link bank, credit, loans, and brokerage to see allocation, fees, and retirement planning—free. Use it alongside YNAB/Monarch/Rocket Money for spending.

What we loved

- Professional-grade portfolio and fee analysis; excellent net-worth history

- Retirement and savings planners feel like “pro tools” at no cost

Where it falls short

- Day-to-day budgeting features are basic; pair with a budgeting app

Best for: People who want free, robust investing & net-worth tracking with basic budgeting.

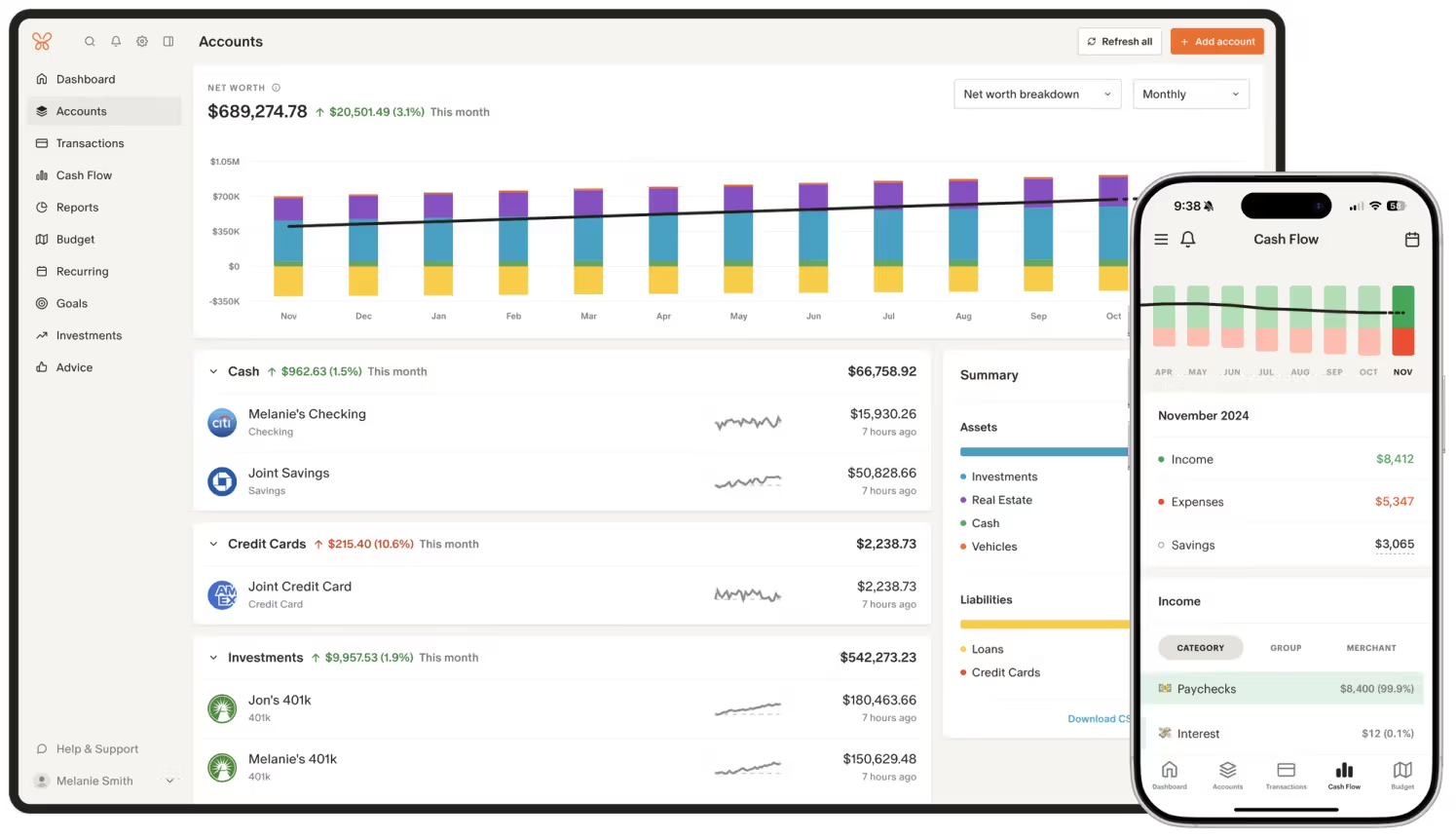

Monarch Money — (8.8/10)

Why it stands out: Monarch is a polished, modern take on household finances—great for collaboration with a partner or family. Shared views, goals, and roll-up dashboards make joint planning feel orderly instead of chaotic.

Highlights

- Multiple users with shared budgets and goals

- Attractive design with flexible dashboards

- Good net-worth view and long-term goals

Trade-offs

- Paid only; fewer hardcore “envelope” mechanics than YNAB

- Some power features (like deep rules/automation) still evolving

Best for: Couples and households that want a unified, elegant money OS.

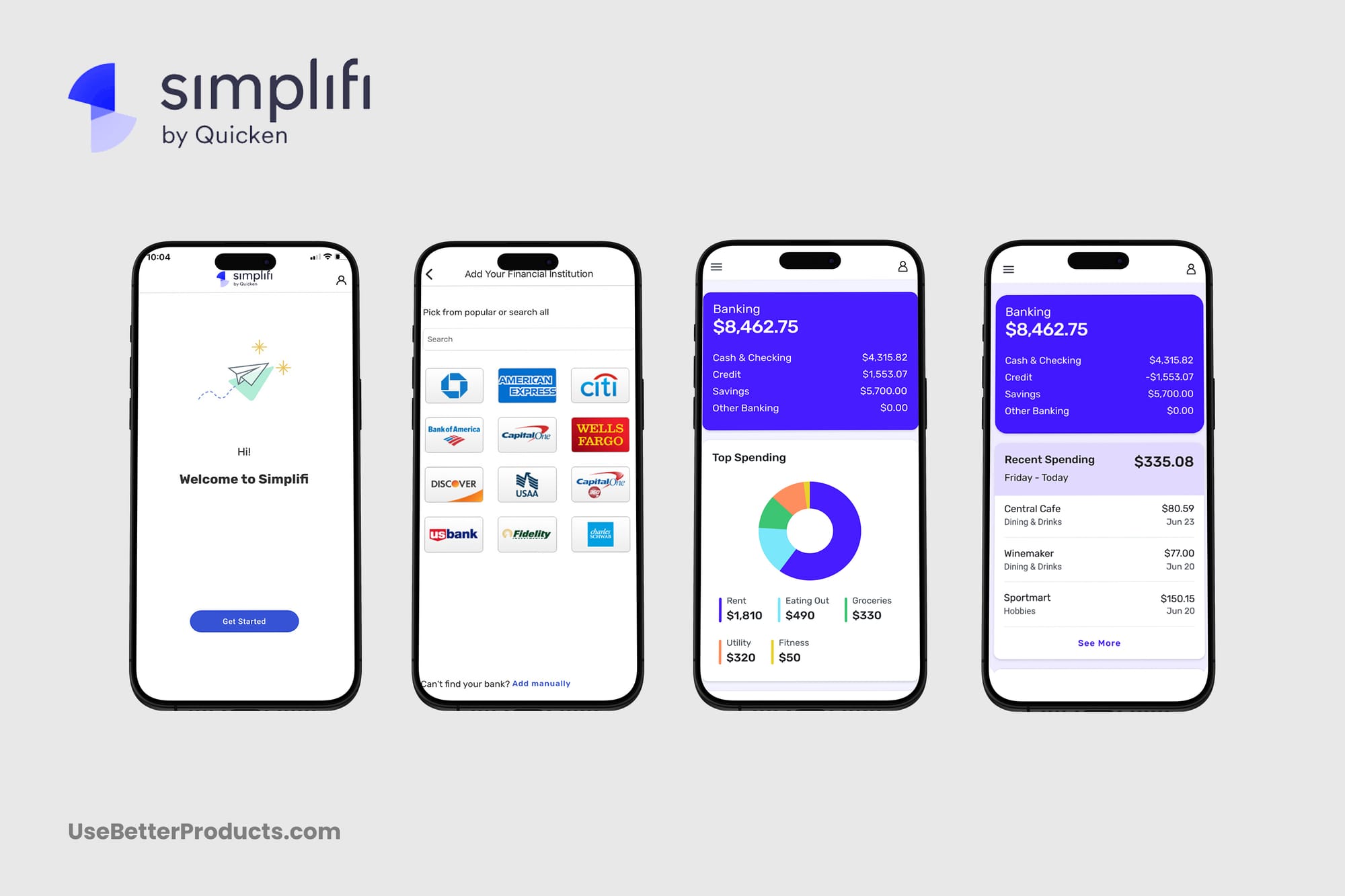

Quicken Simplifi — (8.5/10)

Why it stands out: Simplifi nails the “I just want this to work” brief. The interface is clean, categories are easy to wrangle, and the Projected Cash Flow view is one of the best for seeing next-30-to-90-day money timing.

Highlights

- Auto-categorization that improves quickly with a few rules

- Watchlists to keep tabs on specific merchants or categories

- Clear recurring-bill handling and upcoming-spend timeline

Trade-offs

- Investment tracking is basic

- Annual billing (often promo-priced), no forever-free tier

Best for: People who want a fast, friendly Mint replacement with excellent cash-flow visibility and minimal tinkering.

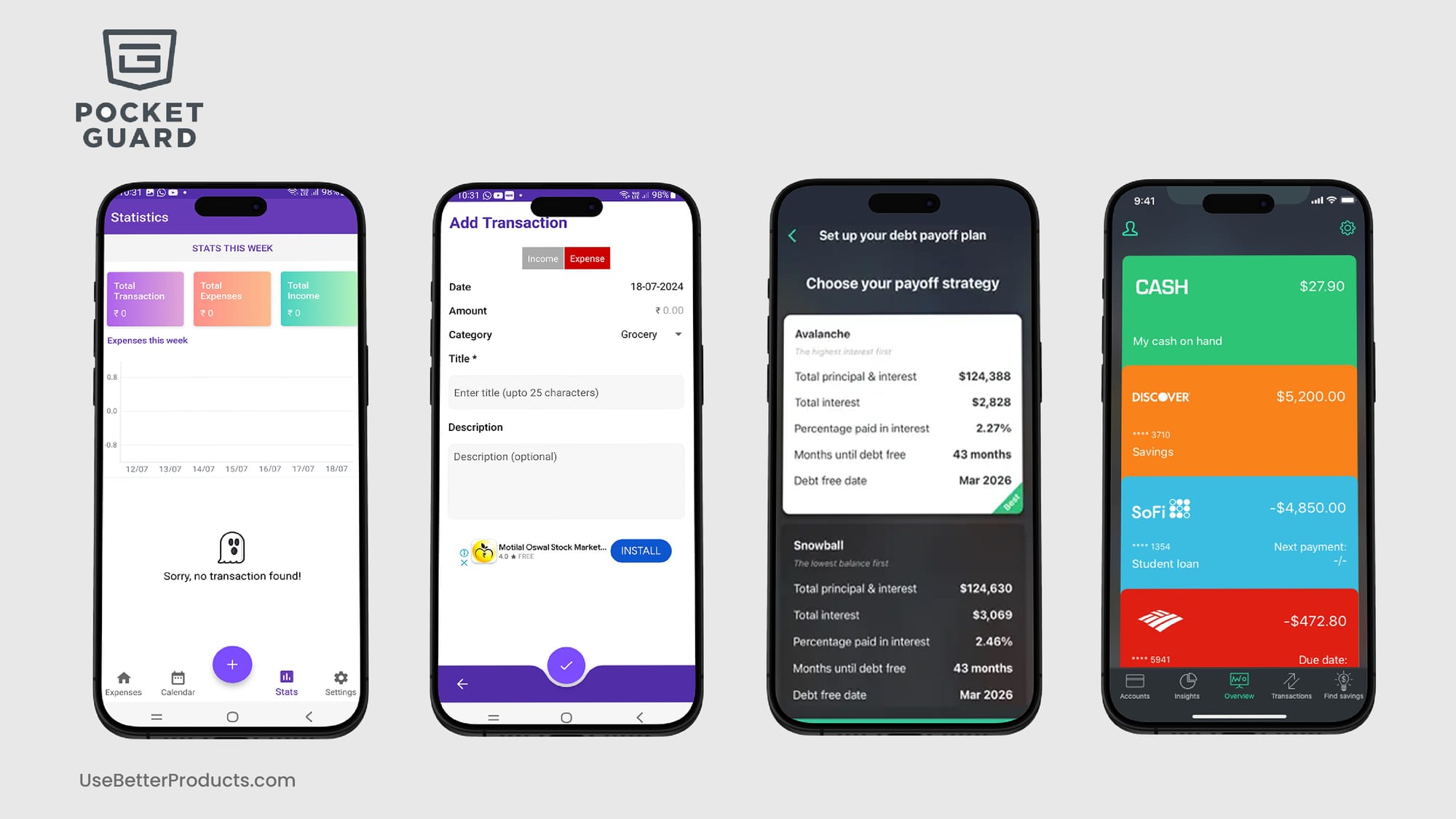

PocketGuard — (7.9/10)

Why it stands out: PocketGuard’s “In My Pocket” number is a simple, motivating guardrail that helps you avoid overspending. The Plus tier adds debt payoff tools and more robust categorization.

Highlights

- Quick “spendable” calculation after bills/savings

- Useful insights and debt planning (Plus)

- Friendly onboarding for budgeting beginners

Trade-offs

- Advanced features require Plus

- Less powerful for investments and multi-account power users

Best for: Beginners and anyone who wants a lightweight spending guardrail.

How to Migrate From Mint (Step-by-Step)

Even if Mint is gone, you can still get up and running smoothly:

1) Pick your destination first

- Want discipline & control? YNAB

- Want easy + automated savings help? Rocket Money

- Want spreadsheets with automation? Tiller

- Want investments/net worth free? Empower

- Want household collaboration? Monarch

- Want quick cash-flow visibility? Simplifi

2) Reconnect your accounts securely

All of these tools use secure aggregation partners (e.g., Plaid) to link banks and brokers. Connect checking, savings, credit cards, loans, and any brokerage/retirement you actually want to track.

3) Import or rebuild history

- Tiller: Import CSVs into Sheets/Excel (Bank export → clean headers → paste into Tiller’s Transactions sheet).

- YNAB: Optional CSV import for recent months; many users start fresh this month to avoid category baggage.

- Monarch/Simplifi/Rocket Money: They’ll auto-pull recent history; add rules and re-categorize the first week for a clean baseline.

- Empower: Links accounts and backfills holdings; add manual assets (e.g., real estate) to complete net worth.

4) Recreate categories & goals (keep it lean)

Start with 10–14 categories plus a few savings goals. You can always expand later. Over-categorization kills momentum.

5) Add automations

- Rules for merchants you see often

- Alerts for big charges, low balances, and due bills

- Savings automations (Rocket Money negotiations, scheduled transfers, or YNAB targets)

6) Close the loop weekly

Adopt a 15-minute weekly money check-in: approve categories, tidy transactions, and review next-week cash flow.

Which One Should I Pick? (Decision Helper)

- “I want the closest all-in Mint replacement” → Rocket Money (8.9/10)

- “We budget together as a couple/household” → Monarch (8.8/10)

- “I need discipline; happy to learn” → YNAB (8.7/10)

- “I love spreadsheets and control” → Tiller (8.4/10)

- “I just want a clean mobile app with great cash-flow” → Simplifi (8.5/10)

- “I mainly want net worth + investments (free)” → Empower (8.4/10)

- “I’m new—give me a simple spend guardrail” → PocketGuard (7.9/10)

Smart combos

- YNAB + Empower: elite budgeting + free investing/net worth analysis

- Monarch + Empower: collaborative budgets + portfolio depth

- Rocket Money + (your bank and broker apps): budgeting + proactive bill savings

- Tiller (hub) + anything: spreadsheet-driven control with add-ons as needed

Security & Privacy Notes (Short)

- Use 2FA everywhere (your bank and the budgeting app).

- Review linked-account permissions annually—remove anything you no longer use. Where possible, use unique login credentials for each connected app.

- Prefer apps that support export (CSV) so you always retain a portable copy.

Testing Methodology (Condensed)

I evaluated with live accounts and real transactions across six weighted criteria:

- Budgeting & Planning (35%) — category control, goals, cash-flow clarity

- Bank Connections & Reliability (20%) — coverage, speed, duplicates

- Net Worth & Investing (15%) — linking, analytics, long-term views

- UX & Mobile (15%) — friction, clarity, onboarding

- Automation & Extras (10%) — subscriptions, bill negotiation, rules, export

- Price-to-Value (5%) — total capability vs. cost

BP Scores reflect the current product state and will be updated as apps ship improvements.

What I Would Enhance

These are the high-impact upgrades that would make Mint alternatives even better for daily use. Note: the Splitwise-style Group Spending feature is something I’d personally use often for trips, group outings, and ad-hoc events. It could also be a great PLG strategy for user acquisition.

Cross-App Improvements

- Group Spending (Splitwise-class) — I’d use this a lot: Premium user creates a Group, invites others via link/QR, everyone logs shared expenses (equal/percent/shares, itemized receipts, multi-currency with FX), and Settle Up via Venmo/PayPal/Cash App. Debt-simplification minimizes IOUs; export CSV/PDF; optional roll-up into the owner’s budget categories with a one-click Trip Report at the end.

- Peer Comparisons: How I compare to similar profiles and peers. E.g. - Am I spending more/less on rent/mortgage?

- Connection health & transparency: Per-bank sync status, last refresh, error detail, and duplicate suppression logs.

- Rules & bulk tools: Global merchant rules, multi-select recategorization, split-transaction templates, and find/replace.

- Better cash-flow forecasting: Clear assumptions (recurring bills, average variable spend), toggles to include/exclude categories, and what-if sliders.

- Data ownership: One-click full export (transactions, categories, rules, goals, attachments) and scheduled backups.Security UX: Forced 2FA, device/session list with revoke, redacted logs for support.

- Migration helpers: CSV mappers for Mint exports + category auto-mapping and a 90-day forecast to get started.

FAQs

What’s the best free Mint alternative? For net worth and investing, Empower is the strongest free option. For pure budgeting, consider free tiers of PocketGuard or start a paid trial (YNAB/Monarch/Simplifi) and decide after a month.

What’s the best overall replacement? For most people, Rocket Money (8.9/10) offers the best mix of subscription tracking, budgeting, and proactive savings via bill negotiation.

What’s best for zero-based budgeting? YNAB (8.7) remains the category leader.

Can I import my old Mint data? If you still have CSV exports, you can import into Tiller and sometimes YNAB/Monarch with light cleanup. Otherwise, link accounts and let recent history populate, then start fresh this month.

Which option tracks investments and net worth best? Empower (free) leads for portfolio analytics and net-worth history. Monarch also does a solid job for households.

What about privacy and security? All options here use secure connections and read-only access for balances/transactions. Turn on 2FA and review permissions periodically.

Conclusion

If you want the closest all-around replacement, start with Rocket Money (8.9). If you want discipline and envelope control, go YNAB (8.7). If you crave custom dashboards, choose Tiller (8.4). For net worth + investments (free), add Empower (8.4). Partners or families will likely be happiest in Monarch (8.8). And if you just want a simple guardrail, PocketGuard (7.9) is enough.

Pro tip: Don’t overthink it. Pick one, run it for 30 days, and do a single weekly money check-in. If it sticks, you’ve found your Mint replacement.

For inquiries or collaboration: Email adam@adamtreister.com — I personally read every message.