Let's face it—managing your money can sometimes feel like herding cats—messy, complicated, and occasionally downright impossible. But here’s the kicker: it doesn’t have to be that way. Enter the digital savior of our times—personal finance apps. These pocket-sized financial wizards are revolutionizing how we handle our money, one tap at a time.

Gone are the days of scribbling expenses on napkins, mentally calculating your monthly budget, or juggling a half-dozen separate apps to manage your money. In 2024, it's all about letting technology do the heavy lifting, so you can focus on making money work for you, not the other way around.

But here's the rub: with a bazillion apps promising to be your financial knight in shining armor, how do you pick the right ones? Fear not, fellow money mavens. We’ve done the legwork, sifted through the digital clutter, and emerged with the cream of the crop in "All In One" personal finance apps.

In this article, we'll review some of our favorite "All-In-One" personal finance apps. And unlike the micro-tools of yesteryear, we consider these the one-stop-shop super-apps and the foundation of your personal finances.

Our mission? To arm you with the inside scoop on the top contenders, breaking down their purpose, features, cost, and more. Whether you're looking to budget and track spending, invest like a pro, or finally get a grip on your debt, we've got you covered.

So buckle up, and let's dive into the digital finance revolution together. Because managing your money should be less about stress and more about success.

Everything We Recommend:

| App | Summary | Better Products Score |

|---|---|---|

| Fidelity | Best overall, especially for power users. | 4.8 |

| Betterment | Best for simplicity, and best for most people. | 4.7 |

| Wealthfront | Runner-up for simplicity and loans. | 4.6 |

| Credit Karma | Best for credit building. | 4.6 |

| Traditional Banks | Best for in-person service. | 4.5 |

| SoFi | Best for loans of all kinds. | 4.4 |

| Acorns | Best for education. | 4.3 |

| Stash | Not recommended. | 4.1 |

What we look for:

- Purpose, Features, and Functionality: Budgeting, investing, credit tracking, etc.

- User Interface and Ease of Use: Importance of a user-friendly design

- Cost: Free vs. paid features, subscription models

- Customer Support: Availability and quality of support services

- User Reviews and Ratings: Summary of user feedback from various platforms

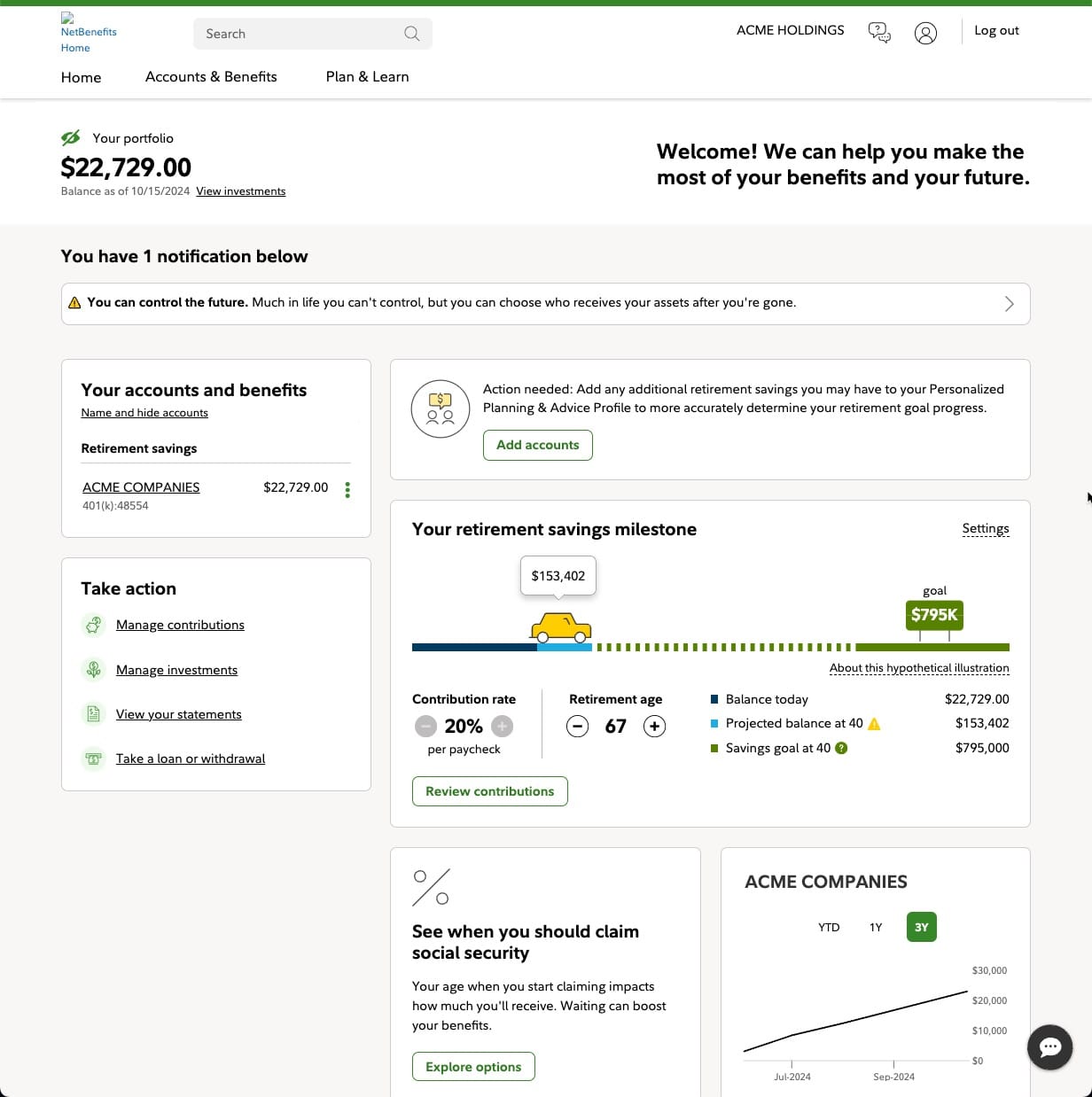

Fidelity Review

Fidelity is another one of our favorite financial services companies. They emphasize long-term planning and offer a broad range of banking and investment products like spending and investment accounts that support stocks, bonds, ETFs, and mutual funds. While Fidelity has been around for a while longer than the new breed of digital-first robo-advisors, they still champion accessibility with a user-friendly interface, $0 account fees, and commission-free trades on U.S. stocks, ETFs, and options, making it a leader in value investing. Fidelity also offers proprietary mutual funds and extensive educational resources to assist investors at all levels. Its Wealth Management services provide personalized investment advice, catering to those aiming for wealth building or retirement preparation. Fidelity combines low costs with a rich educational platform, appealing to intermediate and experienced investors seeking a comprehensive investment solution.

Pricing:

- $0 commission on trades

- Fidelity makes money from the interest on your cash left in your investment accounts. For savvy investors who move their spare cash to high-yield savings accounts or to investments, this provides an opportunity to get a high quality service for practically free.

Pros:

- Comprehensive Financial Services: Fidelity offers a wide array of services, including banking, brokerage accounts, retirement accounts, a large selection of mutual funds, and financial advice, making it a one-stop shop for many investors.

- Zero Expense Ratio Index Funds: Fidelity introduced zero expense ratio index funds, which are highly cost-effective for investors looking to minimize fees.

- High-Quality Customer Service: Fidelity is known for its vital customer service, offering 24/7 access via phone, live chat, and in-person consultations at branch locations.

- Advanced Features and Tools: The platform provides extensive research materials and sophisticated tools catering to intermediate and experienced investors, aiding in informed decision-making.

- No Account Minimums: Fidelity does not require a minimum deposit to open a brokerage account, making it accessible to investors at all levels.

Cons:

- Overwhelming for Beginners: The sheer breadth of options and the sophistication of some tools can overwhelm new investors, making the platform seem daunting to navigate.

- Fee Structure for Certain Services: While many of Fidelity's offerings are low-cost or free, certain services and products come with fees that can add up, such as some managed funds and specific account features.

- Limited International Trading: Fidelity offers less access to international markets than other brokerage firms, which may be a drawback for investors looking to diversify globally.

- Complex Fee Structures on Some Investments: Although Fidelity is known for its low fees, the fee structure on some of its investment products can be complex, requiring careful attention to avoid unexpected costs.

- Some Services Require Higher Balances: While the platform is broadly accessible, certain premium services and financial advice options may require higher account balances, potentially putting them out of reach for newer or less affluent investors.

Conclusion, Fidelity:

Fidelity is a powerhouse in the investment world, offering an extensive range of products and services catering to nearly every investor type. Its commitment to low-cost investing, comprehensive research tools, and excellent customer service make it a strong contender for anyone looking to manage their investments. However, the complexity of the platform and specific fee structures may require a closer look, especially for those new to investing or those with particular needs not fully met by Fidelity’s offerings.

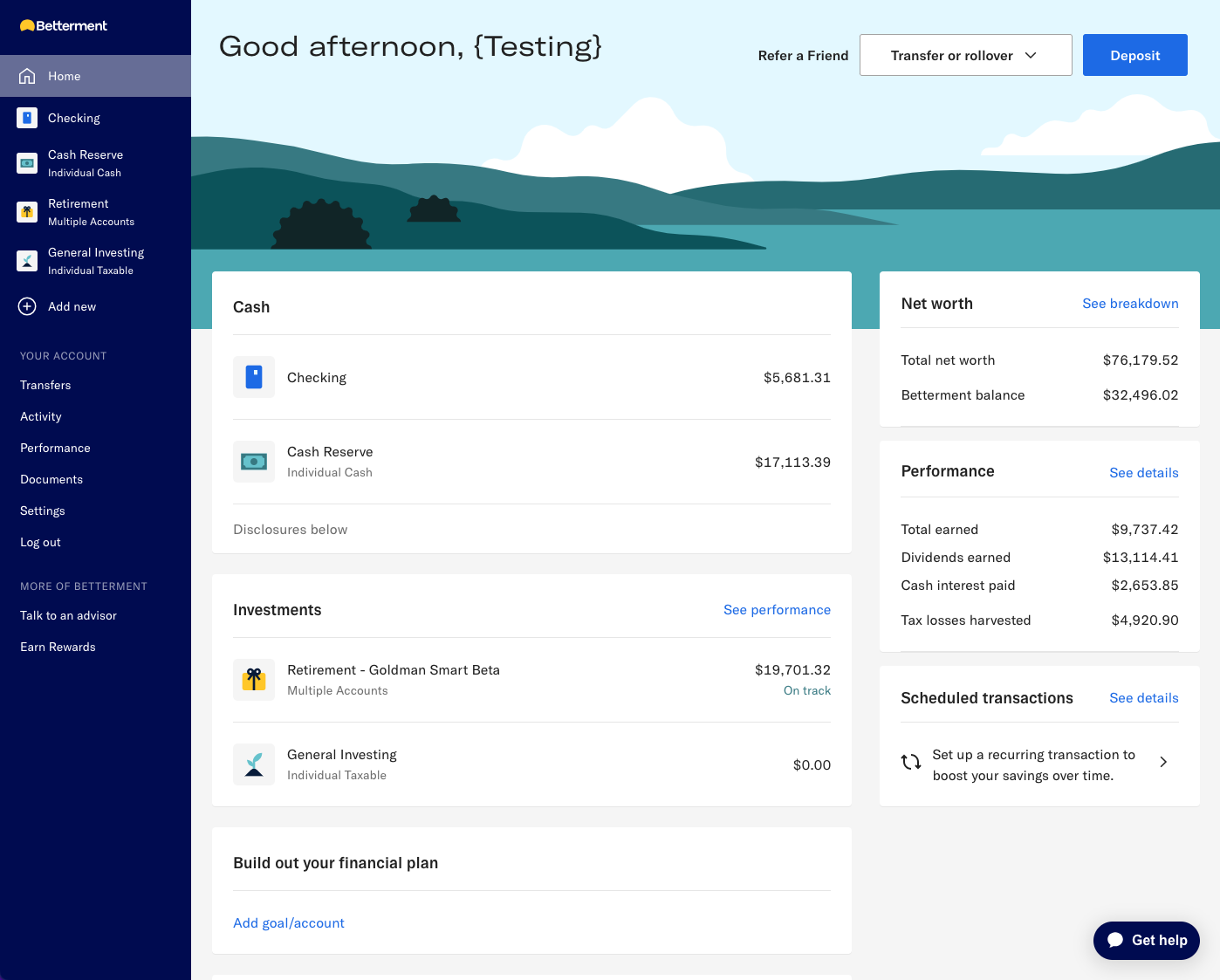

Betterment Review

Betterment, one of our favorite robo-advisors, uses technology to optimize investments, focusing on high returns with low costs and taxes. Its algorithms craft and manage personalized portfolios, adjusting to market changes and your goals. They offer all of the typical account types - including checking, saving, and investment. Betterment is designed for ease and affordability, and it's ideal for new and intermediate investors comfortable with technology-led financial management. With a user-friendly interface, Betterment is great for younger, tech-savvy savers, who prefer simple and competitive pricing, low fees, and a streamlined way to coordinate various account types.

Pricing:

- 0.25% x account balance for basic "Digital" service (annually)

- 0.40% x account balance for "Premium" service, where you gain over-the-phone and email access to a team of Certified Financial Planners who can provide in-depth advice (annually)

- 1.00% x account balance for crypto accounts (annually)

Pros:

- User-Friendly Platform: Betterment provides an intuitive, easy-to-navigate interface, making it accessible for beginner and intermediate investors. The platform's design focuses on simplicity and user experience, ensuring that managing your investments is straightforward and hassle-free.

- Low Fees: Betterment offers a cost-effective investment method with a competitive fee structure that undercuts many traditional investment management services by over half. Its transparent pricing model, based on a percentage of assets managed, means investors can access professional financial advice without the high costs typically associated with personal financial advisors.

- Automated Portfolio Management: Betterment utilizes advanced algorithms to automatically adjust your portfolio to maintain your desired risk level and align with your financial goals. This includes automatic rebalancing and tax-loss harvesting, strategies that can help enhance returns and reduce tax liabilities.

- Goal-Based Investing: Betterment focuses on your financial goals, whether saving for retirement, purchasing a home, or building an emergency fund. It tailors your investment strategy to meet these objectives, making it a personalized investment experience.

Cons:

- Limited Investment Options and Control: While Betterment offers a diversified portfolio of ETFs, it may not satisfy investors looking for a broader selection of investment options, including individual stocks, bonds, or alternative investments.

- Potential for Over-Simplification: While the simplicity and automation of Betterment's platform are major selling points, there's a risk that it may oversimplify the complexities of investing. More experienced investors, or those with specific investment strategies in mind, may find the platform too restrictive.

- No Physical Branches: Unlike traditional banks or brokerage firms, Betterment operates entirely online. This might be a limitation for investors who prefer face-to-face interactions or the ability to visit a physical location.

- Limited budgeting and expense tracking: While Betterment excels with Banking and Investment products, they don't provide much assistance with expense tracking or budgeting. So if you want to track or reduce your spending over time, you'll need to use an additional app for that.

- Loans: Unlike some of the other apps or companies in this list, Betterment does not do loans of any kind. However, they will allow you to pay and track your student loan payments over time - albeit through another institution who actually holds the loan. For home, auto, or other loans though, you'll be forced to look elsewhere.

Conclusion, Betterment:

In summary, Betterment is well-suited for individuals seeking a straightforward, low-cost entry into banking and investing, with the added benefits of automated portfolio management and personalized financial planning. However, those desiring more investment choices and greater portfolio control, in-person financial advice, or loans of any kind; should look elsewhere.

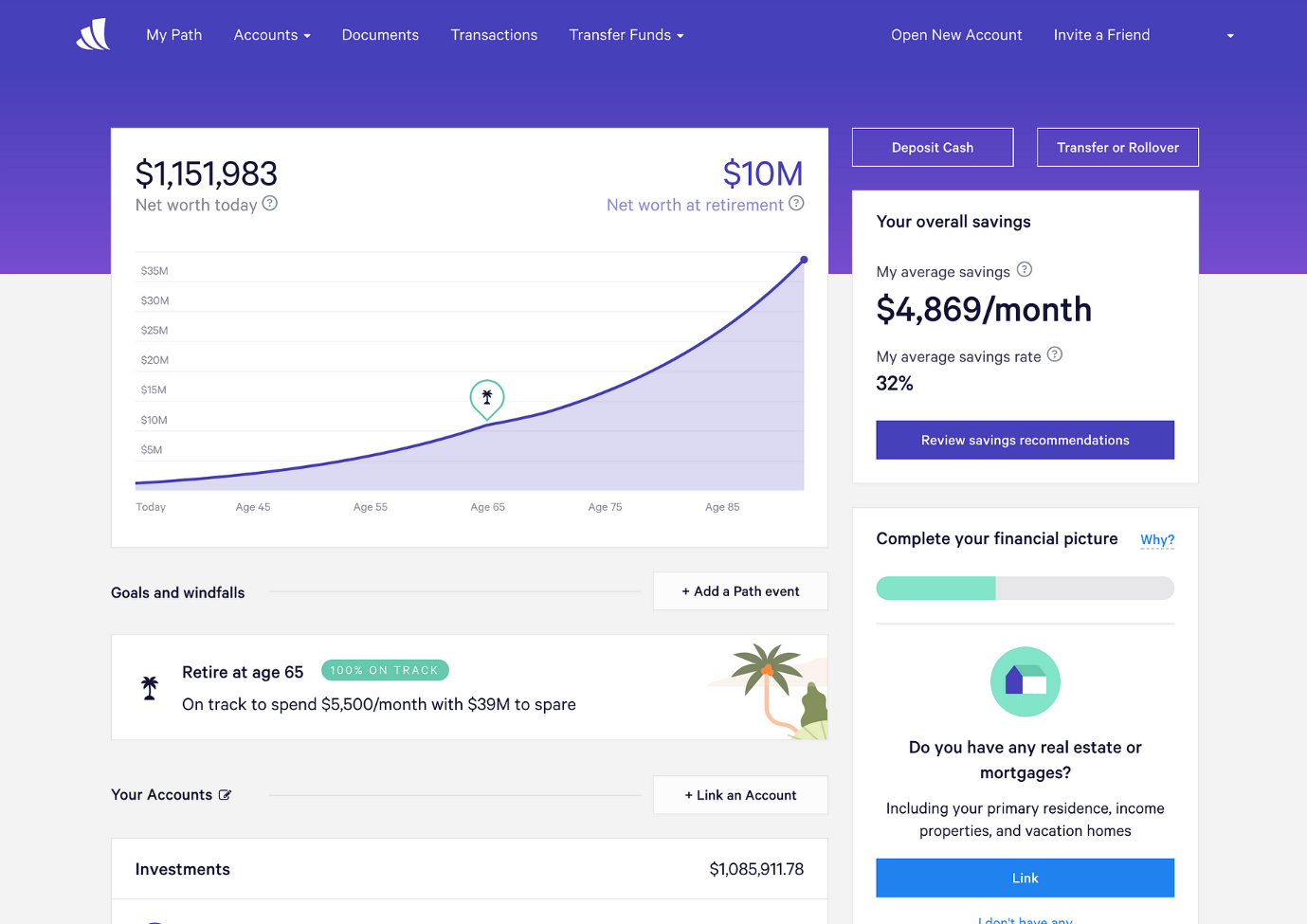

Wealthfront Review

Wealthfront is another one of the digital-first robo-advisors. They use advanced algorithms, a user-friendly interface, and low fees to democratize banking and investment services for all. Like Betterment, Wealthfront automates investing with low-cost ETFs based on your risk preference and goals. It offers services from tax-efficient accounts and retirement savings to high-yield cash accounts and credit lines. Their Path tool is part digital advisor and part calculator, where you can map out and plan for the future of your finances, like big purchases or trips. Wealthfront appeals to those valuing technology's role in investment management by targeting the tech-savvy investor seeking a passive wealth growth strategy. Its appeal is powerful among millennials and digital natives, prioritizing efficiency, transparency, and mobile management.

Pricing:

- 0.25% x account balance (annually)

Pros:

- Comprehensive Financial Planning Tools: Wealthfront's Path tool stands out for its ability to help users plan for various financial goals, including retirement, buying a home, and saving for college, with impressive detail and personalization.

- Automated Portfolio Management: Like its peers, Wealthfront uses algorithms to manage your investments, including automatic rebalancing and tax-loss harvesting, which aim to optimize returns and minimize taxes.

- Low Fees: With an advisory fee of just 0.25% of assets under management, Wealthfront offers a cost-effective solution for investment management, particularly when compared to traditional financial advisors.

- High-Yield Cash Account: In addition to investment services, Wealthfront offers a high-yield cash account, providing an attractive option for your savings with a higher interest rate than many traditional savings accounts.

- Direct Indexing: For accounts with $100,000 or more, Wealthfront offers direct indexing, which can further enhance tax efficiency and potentially improve investment returns over ETFs for eligible accounts. Over a 30+ year time horizon, this can result in substantial savings.

- Portfolio-backed line of credit: For intermediate and advanced investors, you can use your portfolio as collateral to establish a line of credit. This is essentially a loan that you can use to make purchases or leverage for other investments, like real estate.

Cons:

- Limited Human Interaction: Wealthfront's services are almost entirely automated, which might be a downside for those who prefer speaking with a human financial advisor.

- Minimum Investment Requirement: With a minimum investment requirement of $500, Wealthfront may not be accessible to everyone, especially those just starting with investing.

- No Fractional Shares: Unlike some competitors, Wealthfront does not offer the option to invest in fractional shares, which can lead to uninvested cash in your account, potentially reducing overall returns.

- Limited Investment Options: While Wealthfront offers a broad range of ETFs, users looking for a wider variety of investment choices, including individual stocks or alternative investments, may find the platform limiting.

- Less Flexibility for Advanced Investors: Wealthfront's automated approach and focus on ETFs might not satisfy more advanced investors who prefer a hands-on strategy or direct control over individual investment choices.

Conclusion, Wealthfront:

Wealthfront is well-suited for individuals seeking a hands-off investment strategy complemented by solid digital financial planning tools. Its low fees and automated features make it an excellent choice for those new to investing or those who prefer to "set it and forget it." However, the lack of personalized advice and limited investment options may not meet the needs of more experienced investors or those seeking a more customized investment approach. While similar to Betterment, the most significant difference is the ability to take out a line of credit, even if they don't have the ability to talk to a human financial advisor.

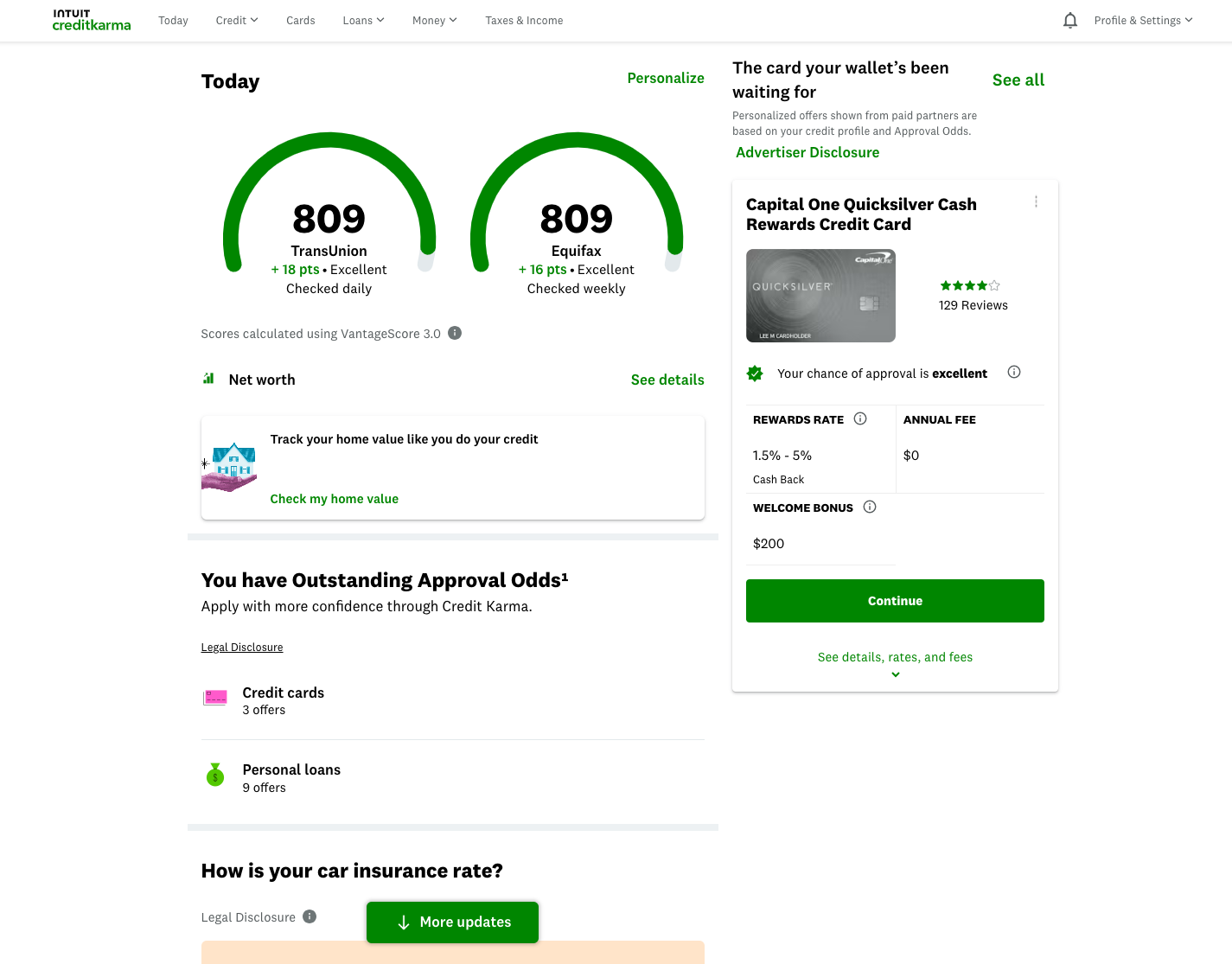

Credit Karma Review

As one of the more familiar companies on the list, Credit Karma shines in the fintech space as primarily a credit monitoring and improvement tool. They provide access to credit scores, reports, and personalized insights to help users improve their credit, though over the years they've expanded to offer a full suite a banking and investment products.

Because their offering is still primarily focused on credit-building, it should come as no surprise that their banking and investment products are not as strong as some of their competitors. While they offer a standard suite of savings, checking, and investment products, we found them often lacking the features and usability of some alternatives.

Pricing:

- $0 - Credit Karma offers its services for free to users. Instead of charging users directly, Credit Karma makes money through a partnership model. They earn commissions from partners when users sign up for financial products like credit cards, loans, or insurance.

Pros:

- Free Credit Monitoring: Credit Karma offers free access to your credit scores and reports from TransUnion and Equifax, updating weekly without affecting your credit score. This is a significant benefit for those looking to keep a close eye on their credit status without incurring any costs.

- Financial Product Recommendations: Based on your credit profile, Credit Karma suggests financial products such as credit cards, loans, and insurance, potentially helping you find options that could be a good fit for your financial situation.

- Credit Score Simulator: The platform includes tools like a Credit Score Simulator, which allows users to see how certain financial decisions (like paying off debt or opening a new credit account) might impact their credit score.

- Educational Resources: Credit Karma provides many articles and tips on credit improvement, financial health, and related topics, making it a valuable resource for those looking to increase their financial literacy.

- Tax Filing Services: In addition to credit services, Credit Karma offers free tax filing services for both federal and state returns, which is a valuable tool during tax season.

Cons:

- Banking and Investment Accounts: These products feel secondary, and not as strong as many of the competitors.

- Estimates, Not FICO Scores: The scores provided by Credit Karma are VantageScore 3.0 credit scores, not FICO scores. Since most lenders use FICO scores for credit decisions, there might be discrepancies between the scores you see on Credit Karma and those lenders see.

- Advertising and Product Recommendations: Credit Karma's business model is based on recommending financial products to its users. While these recommendations can be helpful, they are also based on partnerships with financial institutions, which might not always make them the best choice for every individual.

- Privacy Concerns: To provide personalized financial product recommendations, Credit Karma needs access to your credit report and personal financial information, raising concerns for users sensitive to privacy and data security.

- Accuracy of Information: Some users have reported discrepancies or delays in the information reported by Credit Karma compared to the official credit reports from the credit bureaus, which could lead to confusion or misinformed decisions.

- Limited Customer Support: Given that Credit Karma's services are free, the platform's customer support options may be more limited than those of paid credit monitoring services, potentially leaving users with unanswered questions about their credit reports or scores.

Conclusion, Credit Karma:

Credit Karma is a valuable tool for those looking to monitor their credit and learn more about personal finance without spending money on credit monitoring services. Its educational resources and tools can empower users to take charge of their financial health. However, users need to remember that the credit scores provided are estimates, to take product recommendations with a grain of salt, and to be mindful of privacy considerations. While being essentially free, we can't recommend Credit Karma as a primary "All-In-One" personal finance app.

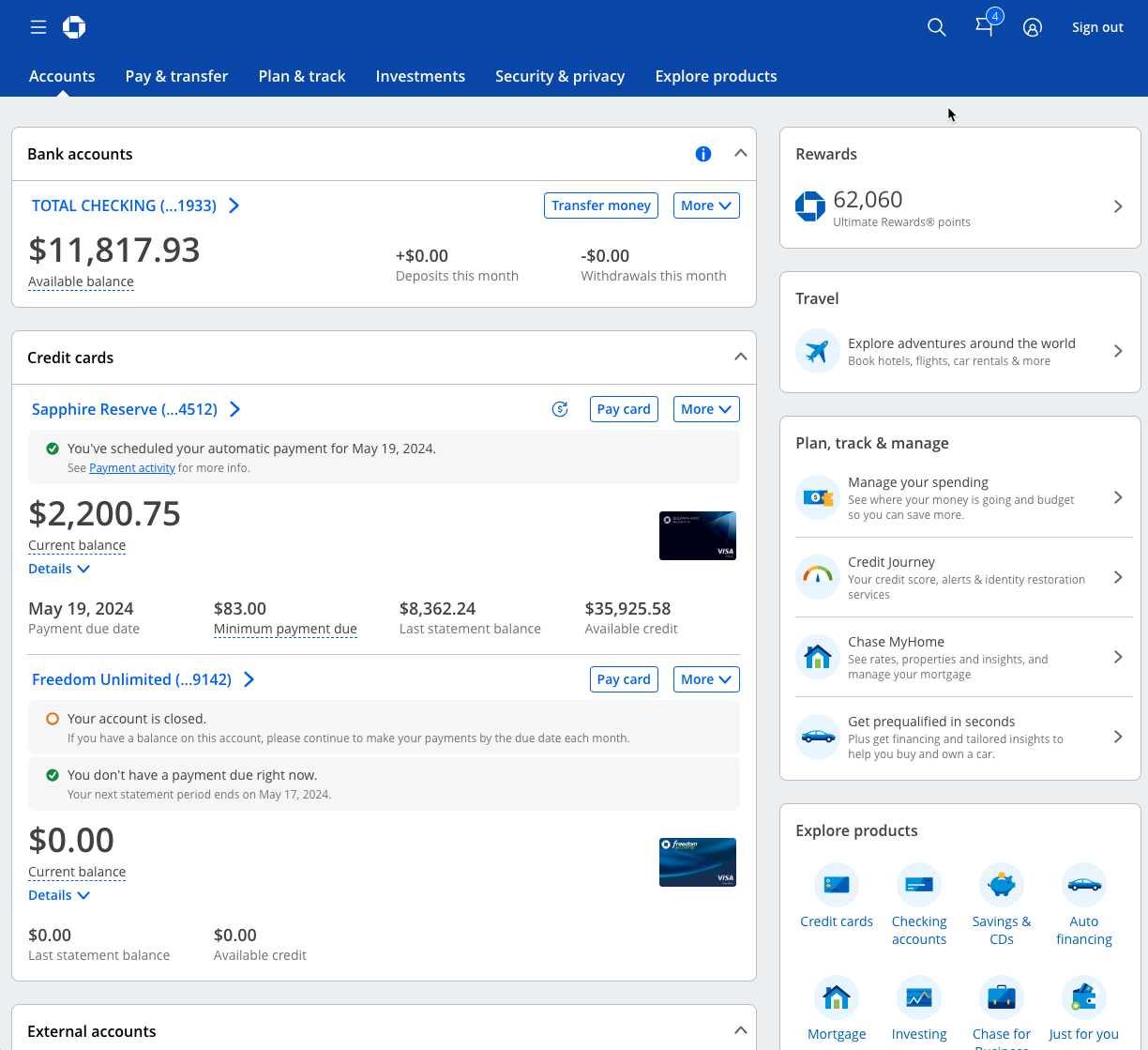

Traditional Banks Review

Let's begin by exploring traditional banking institutions, the cornerstone of financial services. Think of Chase, Wells Fargo, Bank of America, Citi, and any of the dozens of others. These institutions offer a wide range of products, from basic checking and savings accounts to more sophisticated services like mortgages, personal loans, and investment options. Think of them as the Swiss Army knife of finance, providing tools for all your financial needs. Whether you're looking to safeguard your funds, earn interest on savings, finance a major purchase, or plan for the future, traditional banks have you covered. Many banks also offer credit cards, insurance, and wealth management services, making them a comprehensive solution for all your financial needs.

Pricing:

- Pricing can vary widely depending on the product and the level of service required. Basic checking and savings accounts often come with minimal to no fees, especially if you maintain a certain balance or meet deposit requirements. Meanwhile, loans and investment services come with their costs, including interest rates, management fees, and transaction costs.

- For basic services, like Banking and Investments, traditional banks typically charge 2x what some of the digital-first alternatives charge.

Pros:

- Comprehensive Services: Offer various financial products, including loans, savings, checking accounts, and investment services.

- Physical Branches: Provide the option for in-person banking, which can be crucial for complex transactions or for those who prefer face-to-face interactions.

- Established Track Record: Many have been around for decades, offering a sense of security and reliability.

Cons:

- Fees and Minimums: You can have higher costs and minimum balance requirements than digital-first banks (also called "Neo-banks").

- Less Flexible: Often slower to adopt new technologies, leading to less innovative or user-friendly digital experiences.

- Interest Rates: Savings and checking accounts usually offer lower interest rates than what can be found with neobanks.

Conclusion, Traditional Banks:

In summary, traditional banking institutions offer a robust array of products suitable for virtually everyone, with a pricing model that ranges from free to premium, depending on your specific financial needs and how you use their services.

They're ideal for anyone seeking a one-stop solution for various financial needs, from basic banking to loans and investments. They appeal to customers who prioritize the convenience of having multiple services under one roof, the reliability of established institutions, and the reliability of a physical location. Ideal for young adults and retirees, these banks cater to those who value in-person and comprehensive online services. We recommend traditional banks to those looking for a dependable financial partner offering a broad array of products, especially if they appreciate the option of in-person service and the security of dealing with a well-regulated institution.

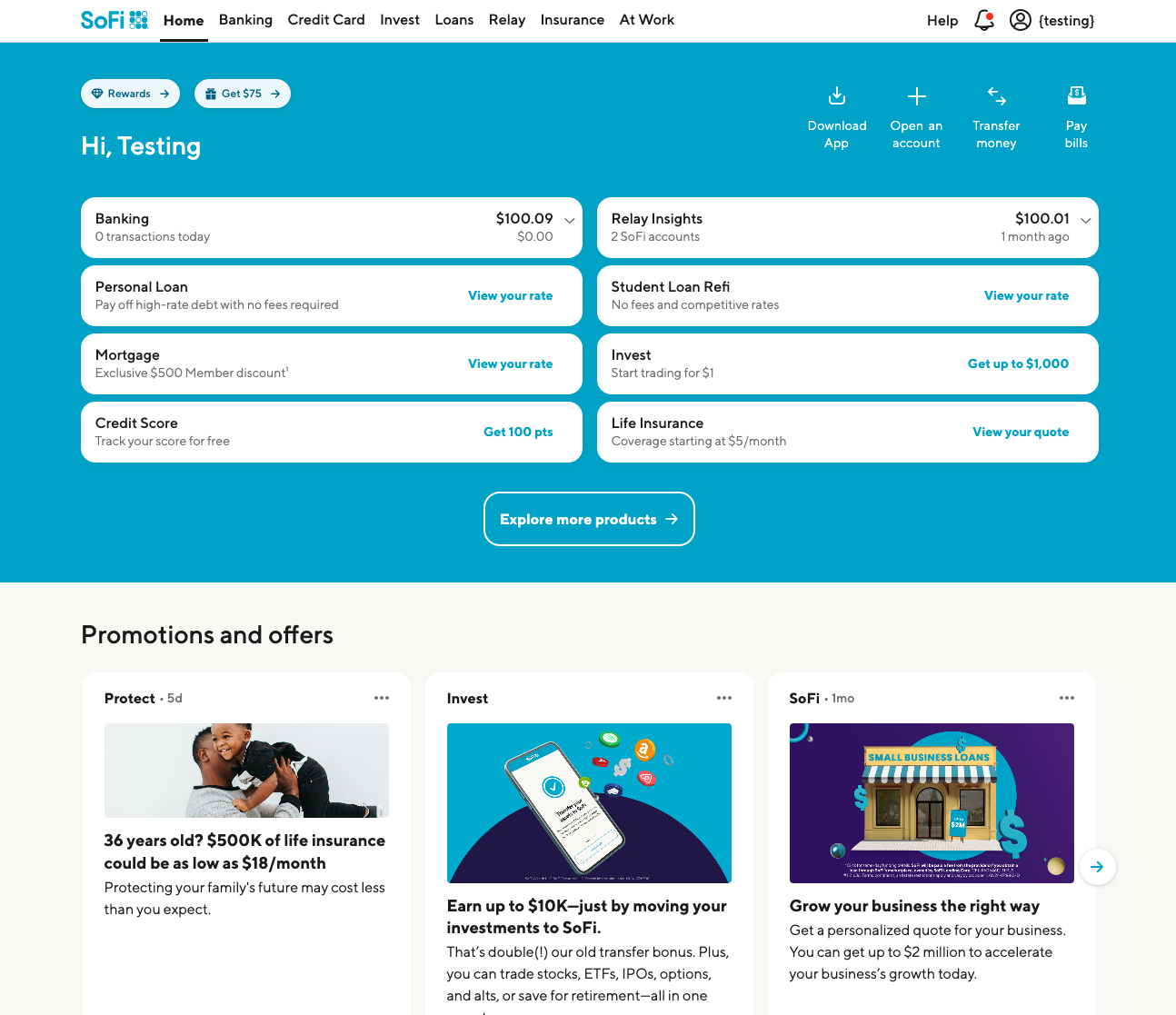

SoFi Review

SoFi, initially known for student loan refinancing, has transformed into a comprehensive personal finance platform offering diverse services, including loans, investing, and banking. Its broad range of offerings and strong community engagement set it apart. Beyond financial services, SoFi provides education, financial planning, and community events to promote overall well-being.

At the core of its product lineup is SoFi Invest, a robo-advisor that offers commission-free trading, making it comparable to other investment platforms. Additionally, SoFi Money stands out as a no-fee, high-yield cash account option.

Designed for young professionals, SoFi combines essential financial services with a community-driven ethos. It caters to individuals seeking a comprehensive financial ecosystem and striving for economic independence without the burden of high fees or fragmented services.

Pricing:

- Banking: $0

- Investments: $0 for normal service, but also:

- $75 fee for full or partial outgoing transfers.

- $25 annual inactivity fee, which you can avoid it by logging into your account at least once a year.

- Loans: Varies by type and individual financial history

Pros:

- Wide Range of Financial Products: SoFi is a versatile platform that offers not just loans (student, personal, and home) but also investment products, insurance, and a cash management account. This broad suite makes it convenient for users to manage various financial needs under one roof.

- Member Benefits: SoFi distinguishes itself with unique perks for its members, including career coaching, financial advice, and exclusive events. These benefits add value beyond traditional financial services and support members' overall financial well-being.

- No Fees for Investment Management: SoFi's investment platform, SoFi Invest, allows users to trade stocks, ETFs, and cryptocurrencies with no transaction fees on most trades, making it an attractive option for investors looking to maximize returns.

- Loans with Competitive Rates: SoFi offers competitive interest rates on its loan products, particularly for borrowers with solid credit profiles. This can result in significant savings over the life of a loan. It is also one of the only All-In-One finance apps to offer a full suite of loans.

- Educational Resources: SoFi provides extensive educational content designed to help users make informed financial decisions and empower them with the knowledge to manage their finances effectively.

Cons:

- Eligibility Criteria: Some of SoFi's products, especially their loan offerings, have stringent eligibility criteria. This can limit access for individuals with less-than-perfect credit histories or those just starting to build credit.

- Limited Physical Presence: While SoFi has begun opening some physical branches, known as SoFi Cafés, its primary operations are online. Those preferring in-person banking or financial services might find it less appealing.

- Investment Platform Limitations: While SoFi Invest offers no-fee trading on many stocks and ETFs, the platform's features and research tools may not be as comprehensive as those provided by more established brokerage firms. This might be a drawback for more advanced investors.

- Customer Service Concerns: Some users have reported issues with customer service, including long wait times and difficulties resolving issues. This is a common challenge among online-first financial services.

- Risk of Account Minimums: SoFi imposes account minimums for certain investment products, which could be a barrier for those looking to start investing with smaller amounts.

- Digital Interface: Compared to some of the alternatives, SoFi's app feels older, less elegant, and more challenging to navigate.

Conclusion, Sofi:

In summary, SoFi is best suited for those seeking a comprehensive suite of financial services from a single digital-first platform, particularly if they value-added member benefits, competitive rates, and loans. However, the limitations regarding eligibility, physical banking preferences, and the depth of investment tools suggest that some users, especially those with more complex financial needs or preferences for in-depth personal service, might need to look elsewhere.

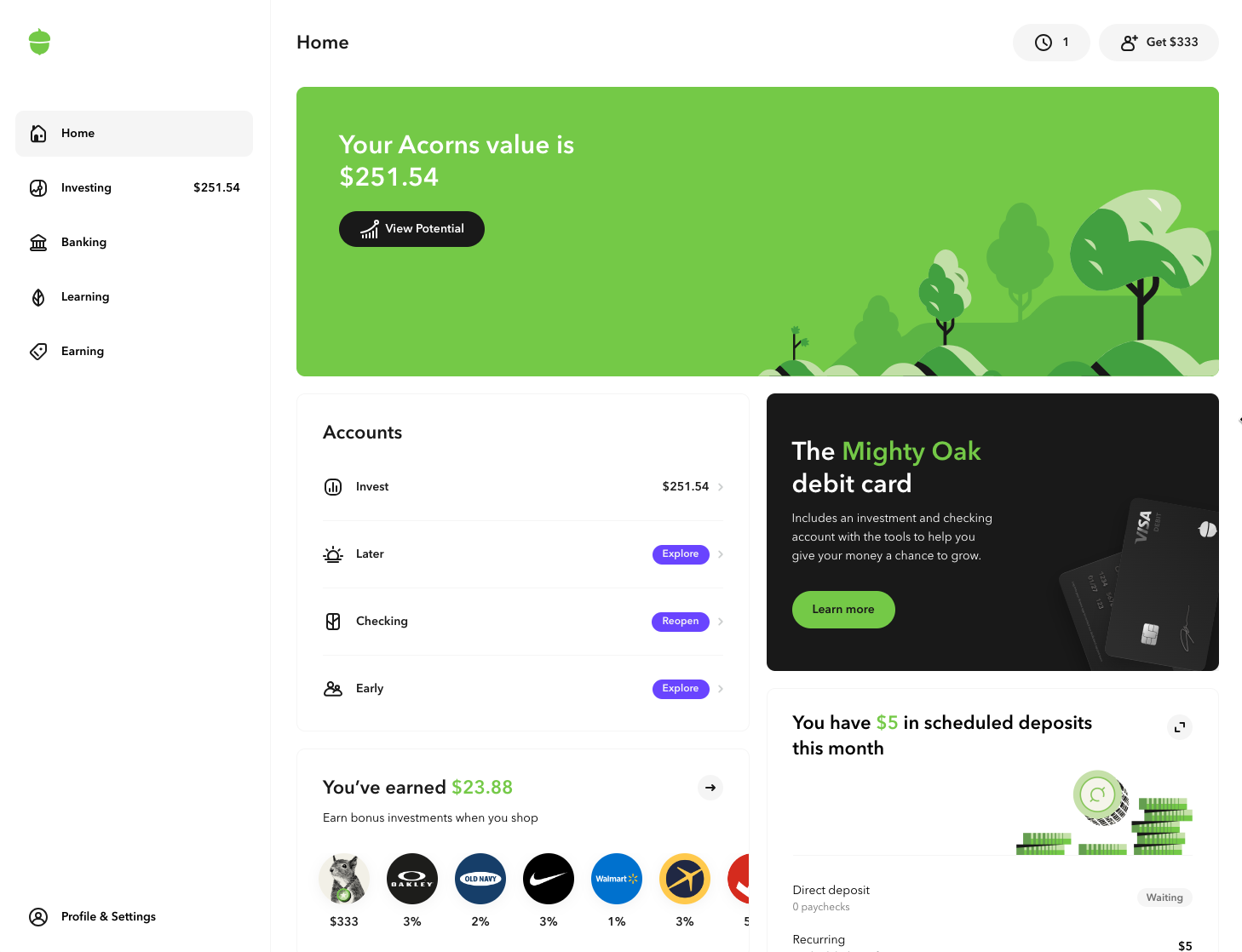

Acorns Review

Acorns has made waves in the fintech industry with its innovative micro-investing app, catering primarily to beginners looking to invest small amounts over time. At its core, Acorns offers several key products designed to simplify investing & banking, while also teaching and encouraging financial literacy.

The core product, Acorns Invest, automates the investing process by rounding up purchases to the nearest dollar and investing the spare change into diversified ETF portfolios (diverse buckets stocks and bonds to prevent you from choosing individual stocks). Additionally, Acorns offers a standard set of retirement accounts and even an investment product for families seeking to invest for their children's future, called Acorns Early.

Acorns also offers some banking products to complement its investment services, like checking and emergency fund accounts - though these seem to lack the standard features that are available by alternative "All-In-One" financial apps.

Acorns offers multiple subscription options, so you can choose whether you want the Good, Better, or Best services. Some of the missing features we'd love to see added include better performance tracking, budgeting and spending analysis, a high-yield savings account, loans, easier transfers in and out (including Zelle), tax lost harvesting, more robust financial planning tools, and additional features for families.

Pricing:

- $3/month for basic services

- $5/month for premium service

- $9/month for families

Pros:

- Ease of Use: Acorns simplifies investing for beginners by automating the investment process, making it an excellent entry point for those new to the market or who might feel overwhelmed by more complex investment platforms.

- Micro-Investing: The round-up feature allows users to invest spare change from daily purchases, which is a painless and incremental way to build an investment portfolio without feeling the financial pinch.

- Diversified Portfolios: Acorns invests users' money into diversified portfolios of ETFs designed by experts to balance risk and return efficiently, which is crucial for long-term investment growth.

- Educational Content: The platform offers a wealth of educational resources designed to demystify investing and personal finance, making it valuable for users looking to increase their financial literacy.

Cons:

- Fees: Acorns charges a monthly subscription fee, which, while modest, can eat into the returns of smaller accounts. For minimal balances, the fee as a percentage of the investment can be high relative to the returns. Especially considering many of the other platforms are free to use.

- Limited Investment Control: Users have limited control over their individual investment choices. Acorns decides which ETFs to invest in based on the user's selected risk level, which might not satisfy those who prefer more direct control over their investment decisions.

- Potentially Slow Growth: Since the platform focuses on micro-investing, the growth of one's investment portfolio can feel slow, especially if not supplemented by regular, more significant contributions.

- Simple Features May Not Suit All Investors: For more experienced investors looking for advanced tools, individual stock selection, or specific investment strategies, Acorns might seem too basic.

- Dependency on Spending for Savings: The concept of rounding up transactions means that saving and investing are tied to spending, which might not encourage all users' most disciplined saving habits.

Conclusion, Acorns:

In summary, Acorns is best suited for brand-new beginner investors who benefit from a simplified, hands-off approach to saving and investing and those looking to learn more about personal finance. Its innovative micro-investing strategy can turn everyday transactions into investment opportunities. However, the platform's fee structure and limited investment options may be drawbacks for either those with either significantly high or low balances, or those seeking more control and sophistication in their investment choices. Though if you're starting out, Acorns is worth a look.

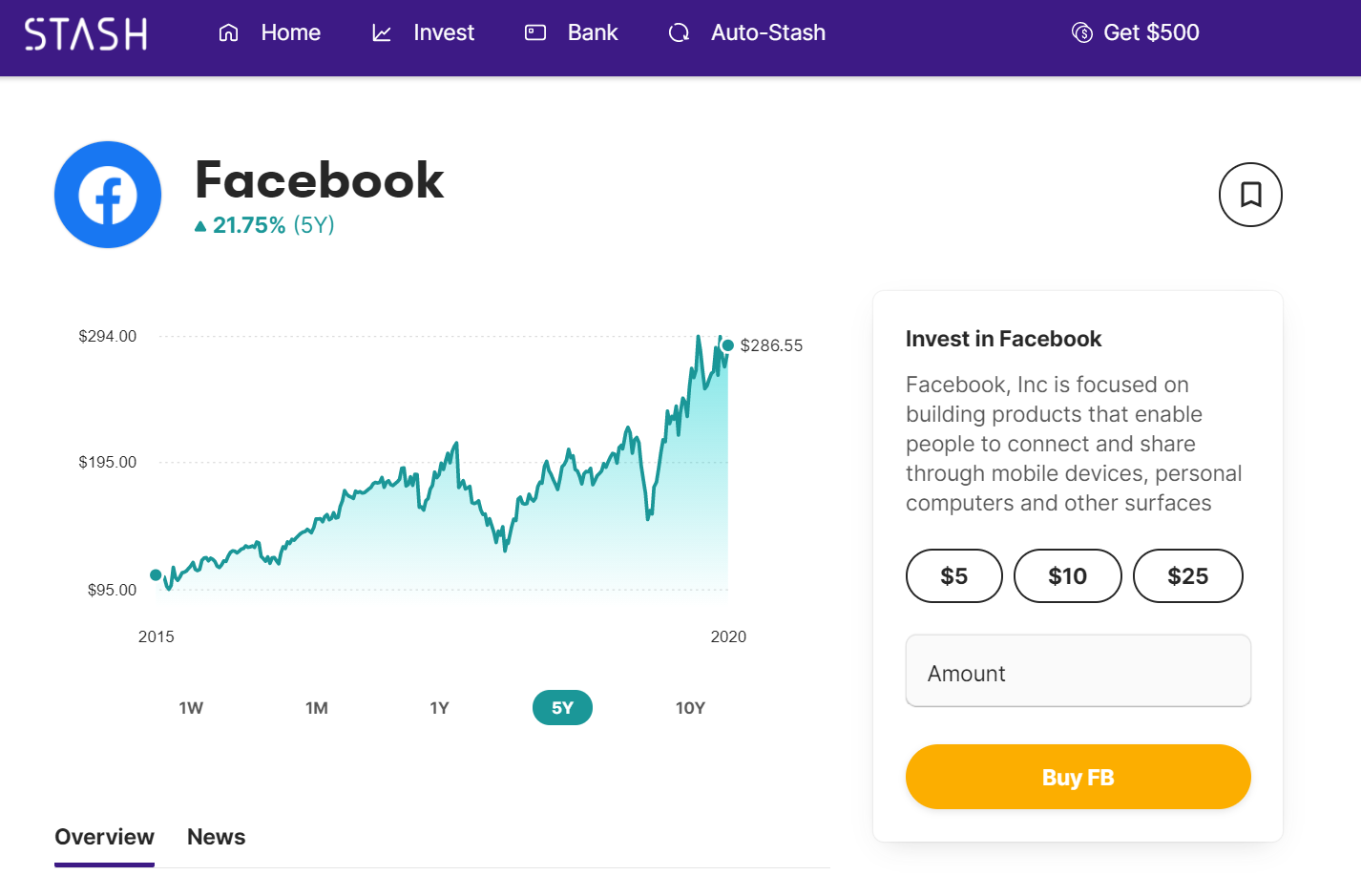

Stash Review

Stash is another entrant in the crowded fintech space that seeks to distinguish itself by simplifying investment for the everyday user. With an app-centric approach, it offers a gateway for those new to investing by requiring minimal initial capital—users can start with as little as $5. However, while Stash's low entry point is commendable, it's essential to consider the platform's fee structure in relation to the services provided, especially when comparing it to alternatives that offer zero-commission trades or no account minimums.

Key offerings from Stash include its banking and investment accounts, options for retirement savings, and a stock-back card that rewards users with shares instead of traditional cash-back perks. The platform's focus on education and easy-to-navigate interface are positives, yet, the monthly subscription fee, which ranges from $1 to $9 depending on the account tier, may not always present the best value for every investor. Particularly, the fee can erode returns on smaller account balances, a critical point when similar platforms offer free basic accounts and only charge for additional services or more sophisticated investment options.

Stash is best suited for beginners who value educational content and support as they start their investment journey. However, for those with a bit more experience or a larger investment to manage, the costs and features of Stash should be carefully weighed against other platforms like Robinhood, Fidelity, or Betterment, which offer more robust features and a wider range of investment options without a monthly fee.

Pricing:

Stash charges its services through a subscription-based model, offering different tiers to fit various needs and budgets. As of the last update:

- $3/month for essential services

- $9/month for premium service

Pros:

- User-Friendly Interface: Stash's platform is designed with beginners in mind, featuring an easy-to-navigate interface and straightforward investment options, which makes it less intimidating for those new to investing.

- Micro-Investing Feature: Stash allows users to start investing with as little as $5, making it accessible to nearly anyone interested in starting their investment journey without requiring a large initial deposit.

- Educational Resources: The app provides a wealth of educational content designed to teach users about investing, personal finance, and managing their money more effectively, supporting informed investment decisions.

- Personalized Investment Recommendations: Based on your risk profile and financial goals, Stash offers personalized investment suggestions, helping users build a diversified portfolio tailored to their needs.

- Fractional Shares: Stash enables the purchase of fractional shares, allowing investors to own a piece of companies they might not otherwise afford, thereby diversifying their investments with smaller amounts of money.

Cons:

- Fees: Stash charges a monthly subscription fee, which can be a drawback for those with smaller account balances. Depending on the plan, the cost may outweigh the benefits for users not fully utilizing the platform's features or those with minimal investments.

- Limited Investment Options: While Stash makes investing approachable, its selection of stocks and ETFs is more limited than that of more comprehensive brokerage services, which might restrict more experienced investors.

- Potentially Costly for Small Balances: Given the subscription fee model, the cost can be high relative to the investment amount for users with small balances, affecting overall investment returns.

- Lack of Advanced Tools: More experienced investors might find Stash's platform lacking advanced trading tools and analytical features that other platforms offer, making it less appealing to those looking to manage their investments actively.

- No Automated Tax-Loss Harvesting: Unlike some competitors, Stash does not offer tax-loss harvesting or other tax optimization strategies, which could be a significant drawback for investors looking to minimize tax liabilities on investments.

Conclusion, Stash:

Stash is a decent choice for beginners who value simplicity and education over sophisticated trading tools and functionality. Its approach to micro-investing and fractional shares makes investing accessible, though we didn't find this unique when compared to alternatives. Additionally, the platform's fees and relatively basic features may not be the best fit for intermediate or experienced investors, or those seeking to maximize their returns and minimize costs.

Everything we recommend:

| App | Summary | Better Products Score |

|---|---|---|

| Traditional Banks | Best for in-person service. | 4.5 |

| Fidelity | Best overall, especially power users. | 4.8 |

| Betterment | Best for simplicity, and best for most people. | 4.7 |

| Wealthfront | Runner-up for simplicity and loans. | 4.6 |

| Credit Karma | Best for credit building. | 4.6 |

| SoFi | Best for loans of all kinds. | 4.4 |

| Acorns | Best for education. | 4.3 |

| Stash | Not recommended. | 4.1 |